The question of the best legal billing software for a small law firm lies at the heart of a larger question: How does a small law firm walk the tightrope of professional obligations and the nitty-gritty of running an office?

Ideal legal billing software for small firms will go above and beyond to support this balancing act, pushing your firm toward operational excellence and financial stability. You want software that understands the unique demands of a law firm, catering to client care as well as the reality of billable hours and office management.

If you’ve been asking yourself, “What is the most popular legal software?” or Googling “best legal billing software,” keep reading. We’ll explore what to look for in billing software, how to choose the right solution for any small law firm, and the best choice for small law firms.

Which Billing Software Is Best for a Small Business Law Firm?

When evaluating billing software, small law firms must consider several factors: ease of use, compatibility with existing systems, and the ability to handle the specific billing intricacies of legal work.

Features like time tracking, invoice generation, and payment processing are fundamental. Yet, the best accounting software for a small business often includes additional functionalities like expense tracking, financial reporting, and even client management tools to foster a seamless flow of day-to-day tasks.

So, when we talk about billing software for small law firms, we’re really talking about finding a multifaceted solution that does more than manage invoices. The best legal billing software should be part of a broader all-in-one practice management platform that ensures tasks — from client intake to final billing — flow without interruption.

To better understand what a small law firm should look for in its billing solution, let’s run through the process of electronic billing in the context of law firm workflows.

What Is the Process of E-Billing?

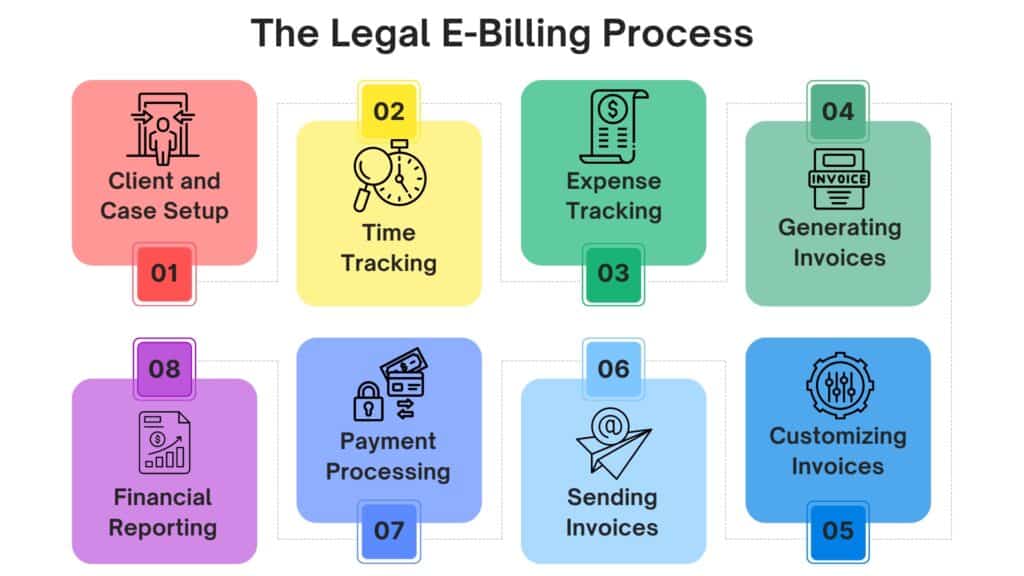

Legal e-billing, or electronic billing, involves recording time and expenses for each case, then generating and sending digital invoices to clients.

In the bustling environment of a small law firm, efficiently managing billing is a significant concern. E-billing streamlines this necessary task, ensuring accuracy and saving time. Here is what the e-billing process looks like, using the legal software PracticePanther as an example:

- Client and Case Setup: Initially, you enter client information and case details into the system. PracticePanther makes this step even more effortless by allowing clients to enter their own information via customizable client intake forms, reducing the risk of manual data entry errors.

- Time Tracking: You record the time you spend on different cases directly into the software. With PracticePanther, you can track time with a stopwatch feature or enter it manually, ensuring you account for every minute.

- Expense Tracking: As you incur expenses, you can immediately record these in PracticePanther with a wide variety of categories to choose from. Whether it’s court fees or travel expenses, keeping track as they happen prevents any oversight.

- Generating Invoices: Once you log your time and expenses, generating invoices is straightforward. PracticePanther automates this, pulling recorded time and expenses into professional-looking invoices.

- Customizing Invoices: Tailoring invoices to reflect the law firm’s branding or specific client needs is simple. PracticePanther offers customization options, from logo insertion to adjusting billing rates.

- Sending Invoices: With a few clicks, invoices are ready to send to clients via email, a text link, or the PracticePanther client portal.

- Payment Processing: Clients can pay invoices electronically through the platform. PracticePanther supports various payment methods, including a built-in payment processor, making transactions smooth for clients and ensuring quicker payment for your firm.

- Financial Reporting: PracticePanther provides comprehensive law firm reporting features, offering insights into billing, payments, and overall financial health. These reports aid in making informed decisions about your firm’s operations.

The efficiency in billing is only part of a broader organizational system; another key component is understanding the types of files law firms need to maintain for comprehensive billing.

What Kinds of Files Do Law Firms Maintain for Billing?

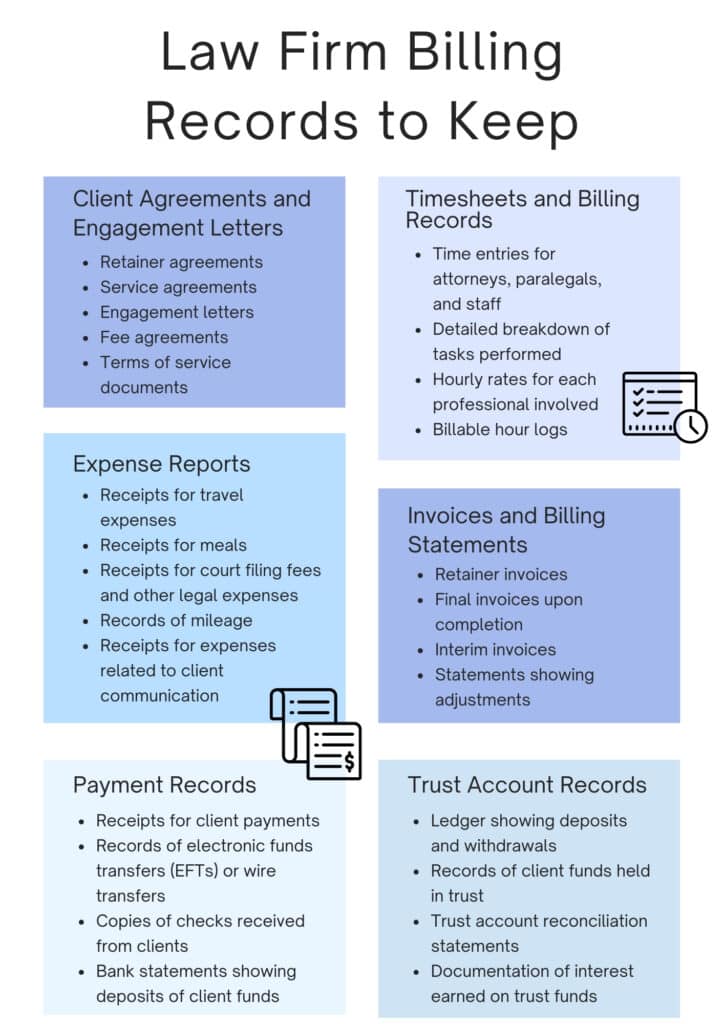

Beyond basic invoices, law firms maintain detailed records, from timesheets to payment records. Each document plays a pivotal role in ensuring transparency and facilitating audits. More specifically, law firms must uphold legal billing guidelines and keep a record of the following:

- Client Agreements and Engagement Letters: These documents outline the scope of services, fee arrangements, and other critical terms of the professional relationship.

- Timesheets and Billing Records: Detailed logs of billable hours worked by attorneys, paralegals, and other staff members.

- Expense Reports: Records of out-of-pocket expenses that are reimbursable by the client.

- Invoices and Billing Statements: Periodic statements provided to clients, detailing services rendered, expenses incurred, and payments received or outstanding.

- Payment Records: Documentation of client payments, including date, amount, and payment method.

- Trust Account Records: For firms that hold client funds in trust, meticulous records of these accounts are mandatory.

- Additional Supporting Documents: The IRS also recommends keeping supporting documents like sales slips, paid bills, receipts, deposit slips, canceled checks, and other related financial records.

In a time of increasing malpractice suits, it becomes even more vital for small firms to create and organize these documents. They serve as a record of your hard work and proof against any allegations a frustrated client may send your way.

Thankfully, legal software like PracticePanther simplifies this recordkeeping. For example, as payments come in, PracticePanther records and reconciles these transactions. It keeps a running log of all payments, including dates, amounts, and methods, facilitating financial audits and client queries with ease.

How Much Does Billing System Software Cost?

The investment in billing software varies widely, depending on the scope of features and the scale of your operations. Law firms must weigh the cost against the expected return on investment, considering the immediate efficiency gains and the long-term benefits in client relations and firm reputation.

Solutions range from cost-effective basic plans to more comprehensive packages that offer extensive customization and integration capabilities. For example, PracticePanther pricing includes multiple tiers of packages starting at $49 a month per user. You can choose whichever package suits your needs and budget, and you can scale PracticePanther as your firm grows.

Try Legal Billing Software Before You Buy

By prioritizing features that align with your workflow and client demands, you can leverage technology to enhance efficiency, accuracy, and client trust. Solutions like PracticePanther can offer valuable insights and solutions without steering your firm toward a one-size-fits-all answer.

We know that making changes to the operational aspects of your firm is no small decision. That’s why we encourage you to try PracticePanther for yourself with a free trial or a no-obligation demo. Take the step, try it out, and see how PracticePanther can contribute to your firm’s success.