While expanding your client base is important for your law firm, it’s even more valuable to retain business with your existing clients. In the Hire and Empower podcast hosted by Molly McGrath, Susan Guthrie, Co-Founder of Mosten Guthrie Academy and a Family Law and Mediation Attorney, emphasized that clients prefer the convenience of online services. By offering online options, law firms can attract more clients.

To meet the needs of today’s clients, law firms should focus on making their services more convenient. One way to achieve this is by offering flexible online payment options that allow clients to pay in a way that suits their financial situation. With PracticePanther’s native online payment processor, PantherPayments, law firms can offer their clients greater flexibility and ease the burden of financial obligations.

In this blog, we will explore the different ways you can improve your client retention rate with PantherPayments.

Client Retention Begins with Convenience: Multiple Payment Options and OneLink

To retain your existing clients, it’s crucial to provide them with convenient payment options that provide them flexibility. With PantherPayments, you can offer your clients the option to pay using their preferred payment method, whether it’s major credit cards, eChecks, or ACH payments, all at an industry-leading low transaction rate. By offering these convenient payment options, you can make it easier for your clients to do business with your law firm and increase the likelihood that they will remain loyal clients in the long run.

In addition to its convenient payment options, PantherPayments can be enhanced by using OneLink, a uniquely generated payment link that makes it even easier for clients to make payments, and for your firm to track where they came from. With OneLink, you can set specific payment amounts, include custom fields, and ensure secure, timely payments from anyone who has access to your link.

To learn more about the benefits of OneLink and how to set it up, check out this article.

Offer Flexible and Customizable Payment Plans

Offering your clients convenient payment options is the first step for retaining their business. But providing them with customized payment plans can take client satisfaction to the next level. With PantherPayments, you can offer flexible payment plans that allow clients to pay in a way that works best for them while ensuring that your law firm is paid in full and on time.

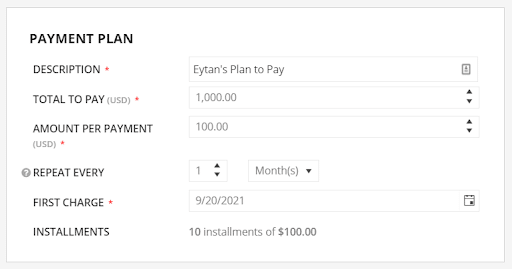

With PantherPayments, law firms can easily set up automated payment plans during the consultation process, allowing clients to pay bi-weekly or monthly over a 6-month or 12-month period, according to their preference. By offering this level of flexibility, you can provide your clients with greater control over their payments and increase their satisfaction and loyalty to your firm. PantherPayment’s customized payment plans are designed to meet the unique needs of your clients and your firm, making it easy to manage payments while delivering exceptional client experiences.

To learn more about how to set up a recurring payment plan, check out this article.

Boost Your Client Retention with Personalized Engagement and Interaction

Providing your clients with convenience and choice is key to boosting your client retention rate, but it’s equally important to engage with them consistently to ensure they feel valued and supported. With PantherPayments, you can easily craft personalized messages for your clients using the note section, keeping them informed and up-to-date on important information related to their payment plan.

For instance, a simple note like, “Thank you for your payment, <Client Name>! We appreciate your business and look forward to helping you resolve your legal matter. If you have any questions or concerns, please don’t hesitate to contact us at <Phone Number>,” can go a long way in making your clients feel appreciated and cared for.

By using the note section to add a personalized touch with your clients, you can build trust and strengthen your relationship with them over time. This will not only boost your firm’s reputation but also help you retain more clients in the long run.

Build Client Trust with Security Measures

Building trust is no doubt essential in establishing a healthy business relationship with your clients. At the outset of your client relationship, it is important to assure them that their information, including their banking details, is kept safe and secure at all times. PantherPayments provides peace of mind to both you and your clients by ensuring that trust and operating funds are always separated in accordance with regulatory guidelines, giving your clients confidence in the security of their money.

If your clients express concerns about the security of their information, you can further assure them that PracticePanther utilizes strong security measures, including 256-bit military-grade encryption and a two-step authentication method. These securities make it almost impossible for unauthorized parties to access your sensitive information. With PantherPayments in PracticePanther, you can rest assured that your client’s data is secure, and their trust is valued all the time.

Say Goodbye to Client Retention Worries with PantherPayments

Retaining clients can be a challenging task for law firms, but offering convenient and secure payment options is one of the easiest and most effective ways to achieve it. PracticePanther’s native payment processor, PantherPayments, empowers law firms to provide their clients with multiple payment options, including credit cards, eChecks, and ACH payments, as well as customizable payment plans. By using PantherPayments, law firms can improve customer satisfaction, increase client loyalty, and enhance their firm’s reputation in the legal industry.

If you’re interested in learning more about PracticePanther and all of the other top-notch features we have to offer, start your free trial today! If you’re an existing customer and want to implement PantherPayments, follow these steps to activate your account.