As an attorney, your time is your most valuable asset, and understanding exactly how much it’s worth is essential for building a profitable and sustainable legal practice.

Whether you’re hanging your shingle for the first time or revisiting your fee structure after years in business, determining your ideal hourly rate is a strategic decision. Your competition, client expectations, and business goals evolve over time, so it’s critical to consistently evaluate your pricing to ensure it reflects your value and keeps pace with the market.

But setting your hourly rate isn’t as simple as picking a number out of thin air. You need to balance your income goals with your firm’s overhead costs, business growth plans, and what your clients are willing to pay. All while staying compliant with ABA Rule of Professional Conduct 1.5, which requires legal fees to be “reasonable.”

And then there’s external pressure. According to Above the Law, rate pressure, or client reluctance to pay fees, is the second most common challenge small law firms face (21%), right behind acquiring new clients at 27%.

So, how do you determine your ideal hourly rate as a lawyer?

Before you consider lowering your price to meet client expectations or match a competitor down the street, this guide will help you calculate a rate that reflects your worth, covers your business needs, and supports long-term growth.

How to Calculate Your Ideal Billable Hourly Rate

Choosing your hourly rate isn’t about matching your peers or undercutting the competition; it’s about building a sustainable practice that works for you. That means setting a number that:

- Covers your expenses

- Accounts for business growth

- Supports your desired quality of life

- Reflects your unique value as a legal professional

Let’s break down the key factors in calculating an hourly rate that aligns with both your personal goals and professional obligations.

1. Decide What You Want Your Take-Home Pay to Be

One of the reasons you entered the practice of law is earning potential….. While starting your own business comes with many fulfillments, your income is still one of the most important factors, not only as an attorney but also as a business owner.

In order to begin the equation here, you will first want to start by setting a target for your take-home pay. This should reflect your cost of living, financial goals (e.g., saving for retirement, student loans, or buying a home), and the standard salary range for your experience and area of law.

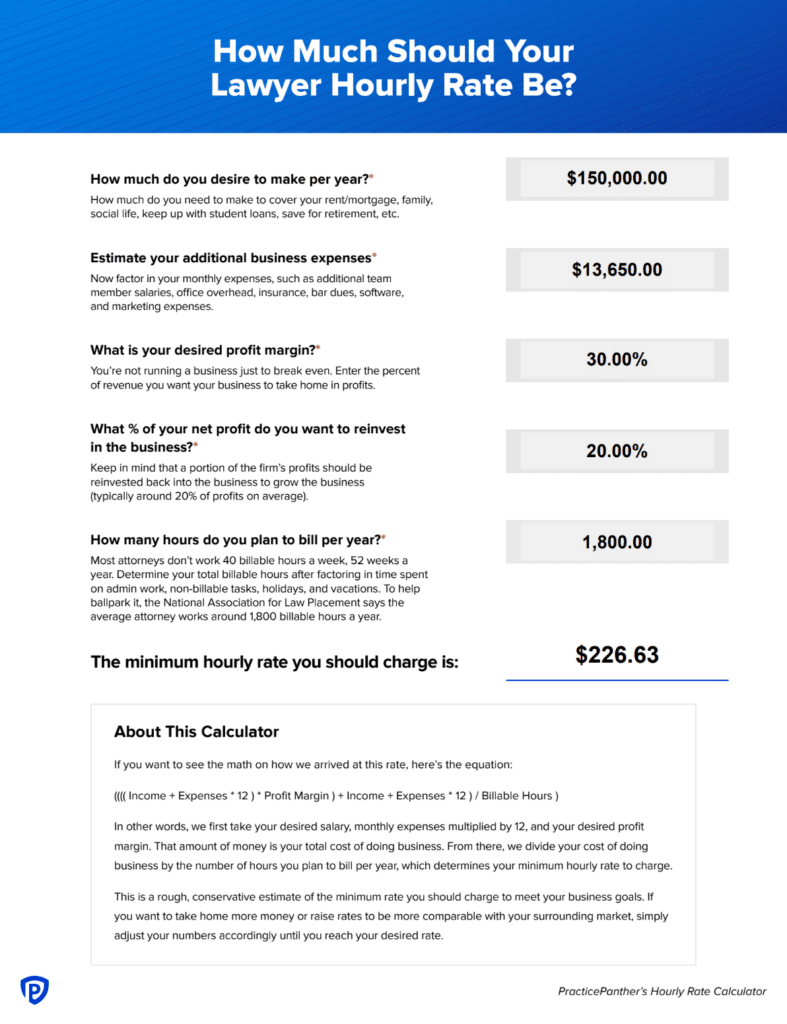

Example: Let’s say you’ve determined that $150,000/year is commensurate with the going rate in your practice area for attorneys with your experience and credentials.

2. Add Up Your Additional Monthly Firm Expenses

Next, total up the operational costs to keep your law firm running with the necessary additional employees. Even if you’re working from a home office, you’ll likely have recurring costs that add up quickly based on various factors, including location, size, and specialization.

Here’s a range of what additional monthly expenses might look like for a small law firm across the country:

- Office rent and utilities (electricity, water, internet): $2,000 – $4,000

- Single staff salary (e.g., paralegal, admin staff): $5,000 – $7,000

- Legal research and software subscriptions: $200 – $450

- Liability insurance premiums: $200 – $400

- Marketing expenses: $2,000 – $4,000

- Office supplies and equipment: $100 – $300

- Continuing education & training (CLE): $80 – $100

- Professional fees and dues: $70 – $200

- Travel expenses for client meetings/court appearances: $150 – $400

- Miscellaneous expenses: $150 – $500

Adding up all of the midpoints of these expense ranges totals about $13,650 a month or $163,800 annually. After adding your desired salary of $150,000, your total annual firm expenses equal $313,800.

3. Set Realistic Profit Targets for Your Business

When starting your own law firm, one of the most important financial decisions you’ll make is setting a realistic profit target. This target isn’t just about how much money you want to take home—it’s about creating a sustainable business that allows for both personal reward and long-term business growth.

Running any business comes with inherent risk. As the owner, you need to decide what you want to prioritize: maximizing your own compensation in the short term or reinvesting in your firm to build something more valuable over time. Ideally, your profit target should allow you to do both.

This step is crucial, as deciding what percentage you desire your profit margin to be will later help determine how much revenue you will need to generate. The average profit margin for small law firms typically falls between 25% and 35%. For the sake of clarity and planning, we’ll use 30% as a baseline example.

Of that 30%, a healthy practice would aim to reinvest about 20% of profits back into the business. This could mean upgrading your tech stack, hiring new staff, or expanding into new practice areas—investments that plant seeds for future growth. Think of this reinvestment as a cost of doing business, just like rent or software subscriptions. It should be factored into your pricing and profitability goals from day one.

Ultimately, your goal shouldn’t just be to break even. You want your firm to earn enough to cover operating expenses, reward yourself for the risks you’ve taken, and reinvest meaningfully to set the stage for long-term success.

4. Calculate Your Total Required Revenue

Now that you’ve totaled your monthly and annual expenses and set your realistic profit margins, it’s time to determine how much revenue your firm actually needs to bring in to operate and grow.

At a minimum, your annual revenue must cover your full cost of doing business, in addition to your desired profit.

To continue with our example, let’s say you plan to hit a profit margin of 30%, then reinvest about 20% of that profit margin back into the business. Your total annual firm expenses total around $313,800. That means your total required revenue is:

$313,800 (total expenses) + $94,140 (30% profit margin) = $407,940

So $407,940 in revenue becomes the baseline target your billable hours need to meet (or exceed). The next step will break that figure down by your realistic hours to help determine your ideal hourly rate.

5. Determine How Many Hours You Can Actually Bill

Now that you’ve set your income, expenses, and profit goals, the next question is: how many hours can you realistically bill in a year?

Most attorneys don’t work 40 billable hours a week, 52 weeks a year. You need to factor in time off for holidays, vacation, and the occasional sick day.

So what does this look like?

- With 260 weekdays a year, minus 10 national holidays and around 3 weeks of vacation/sick time, you have around 235 workable days left

- At 8 hours a day, that’s 1,880 total work hours per year

But here’s the catch: It’s unrealistic to bill for every hour you work.

Between administrative tasks, client communications, business development, CLE sessions, etc., billable hours typically only make up around 45%-65% of your workday. So if you want to maintain an 8-hour workday, it’s reasonable to expect around 5-6 hours per day to be billable, especially if you’re handling most of your own admin tasks.

It’s important to consider: Are you trying to build a firm that requires 11-hour days to stay profitable, or one with more flexibility to consistently log off at, say, 5 or 6 PM?

However, according to the National Association for Law Placement (NALP), the average attorney works around 1,800 billable hours a year (or about 35 billable hours per week). So, for our example, we will use 1,800 billable hours in our hourly rate calculation.

6. Do the Math: Your Ideal Hourly Rate

Now that you have all your variables covered, let’s plug them into the formula:

- Calculate your total operational expenses (take-home pay + additional expenses): $313,800 annually ($26,150/month)

- To reach your desired profit margin of 30%, you need to bring in an extra $94,140

- Factor in what you plan to reinvest in the business from your profits: Which 20% of the $94,140 profit margin is $18,828

- Calculate your total required revenue: Combining your take-home pay, expenses, and desired profit margin adds up to $407,940

- Calculate your base billable hourly rate: To determine a baseline for how much your time should be worth, divide your total cost of doing business by your minimum annual billable hours (we’ll use the 1,800-hour example here), which works out to about $227 per hour. ($407,940 / 1,800 = $226.63)

In our example, the minimum hourly rate to reach your financial and business goals is $227. If you charge less, you’re more likely to fail.

7. Compare Against Market Rates

While we can get close to the market rate with the above calculations, there are a few reasons why the numbers may differ when put into practice. It’s important to consider the following as a final step.

- Specialized areas like intellectual property, tax law, or corporate law often command rates of $400/hour or more

- Your location matters too. Attorneys in major metro cities like New York or San Francisco typically charge more than those in smaller towns

- Not every hour you bill is an hour you’ll actually collect on. You might expect a portion of your billed income to go unpaid between client disputes, discounts, and internal write-downs. In fact, partners write off over 300 hours of their own potentially billable time per year, resulting in nearly $190,000 in lost fees on average.

Be sure to check your state bar association, which can provide more localized market data and salary trends with breakdowns in law firm type and practice areas. Also, now that you have your baseline hourly rate calculated, you can talk to colleagues to get a better idea of how their hourly rate compares to yours.

Use This Free Lawyer Hourly Rate Calculator

Want to plug in your own numbers? Download this free calculator and enter your ideal hourly rate based on your goals, expenses, and billable hours to determine your billable hourly rate.

Boost Your Earning Potential with the Right Tools

Once you know how much your time is worth, the next step is to maximize it. One of the easiest ways to increase profitability without raising your rate is to bill more efficiently.

With a legal practice management platform like PracticePanther, you can:

- Track billable time automatically from emails, calls, and tasks

- Set billing goals and track your performance throughout the year

- Reduce admin time with automated invoicing, payment reminders, and batch billing

- Get paid faster with integrated online payments

When your operation runs smoothly, you free up more time for billable work and get closer to hitting (or exceeding) your hourly rate goals.

Setting your hourly rate shouldn’t be a guessing game. By evaluating your desired income, actual business costs, and profit goals, you’ll gain confidence in your pricing and avoid undervaluing your services.