On average, prices for legal billing software solutions range from approximately $50 to over $100 a month per user. This variability in pricing mirrors the diversity of features, scalability, and support options available, catering to the specialized requirements of legal practices.

In 2021, the global market for legal technology demonstrated remarkable growth, reaching revenue figures close to $27.6 billion, setting a trajectory toward $35.6 billion by 2027. Amidst this growth, small law firms stand to benefit significantly from advanced technologies designed to simplify and improve billing practices.

However, finding the right legal billing software for small firms can be a complex decision. You must select a solution that meets your firm’s immediate needs and aligns with your long-term growth strategies.

So, if you’ve been asking, “What billing software do law firms use?” keep reading. This blog will walk you through exactly what to look for in billing software, how it works, and how to set it up at your firm.

What Software Do Law Firms Use for Billing?

Law firms often select software that simplifies invoicing, tracks work hours, and streamlines client payments. Beyond these critical features, here are the other top features that should be included in the best invoicing software for a small business:

- Client payment portals that facilitate easy and secure transaction processes.

- Integration into an all-in-one practice management solution.

- Report generation capabilities for a clear view of financial standings.

- Customizable billing rates to accommodate the diversity of cases and client agreements.

- Data security measures that protect sensitive client information.

- Mobile access for billing on the go.

- Reminder systems for overdue payments.

- User-friendly interface that doesn’t require extensive training.

- Templates for standard billing documents.

- Custom fields for unique billing needs.

- Expense tracking to include all costs in bills.

- Document management capabilities for storing relevant billing documents.

Keep in mind that the price of billing software can change based on the features you get. Some software offers basic options that are enough for handling everyday invoices and tracking time spent on cases. These are usually less expensive and work well for smaller firms or solo practitioners who require straightforward solutions without extra bells and whistles.

On the other hand, larger firms with more complex needs might look for advanced features like detailed financial analytics or LEDES billing support. These can make managing multiple clients and cases much easier but also come with a higher price tag.

To accommodate different sizes and types of legal practices, some software providers offer various pricing levels. This way, your firm can start with what you need now and have the option to upgrade as you grow, making sure you’re always covered without breaking your budget.

Is There a Tool to Track Billable Hours?

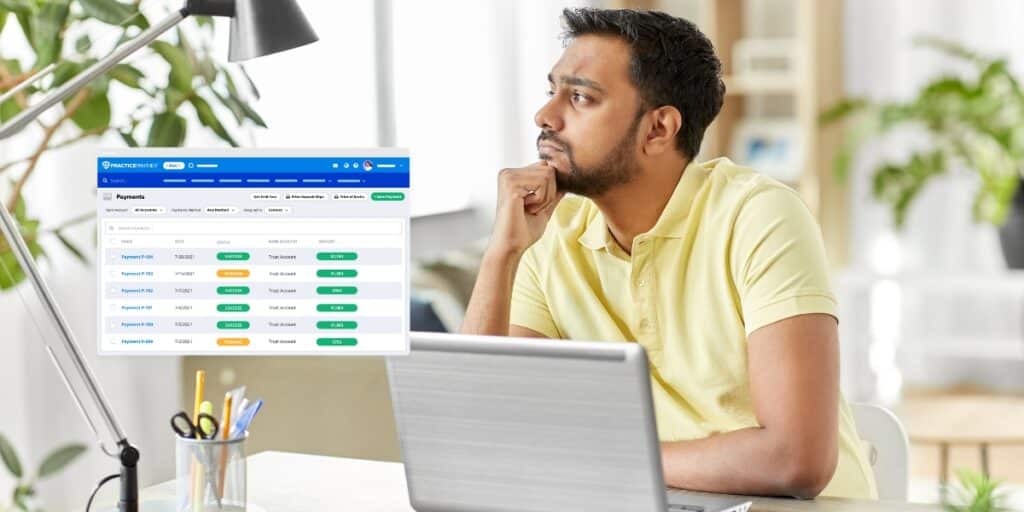

Legal software is the best option for lawyers looking to track billable hours. For example, PracticePanther allows you to manually input time after completing a task or use integrated timers that run while performing any task.

Manual input is ideal for post-task documentation. After a meeting or court session, you can log the exact minutes spent, especially if the software you use has a corresponding mobile app. This method prevents any forgetfulness that might occur if logging is delayed until the end of the day.

On the other hand, using the timer function can increase accuracy as it records the time spent on a task in real time. As soon as a task begins, you can start the timer, which will run until you stop it when the task is complete. You can also pause the timer if you need to switch to a different task and use a separate timer. This method ensures that you account for every minute, helping to avoid disputes over billing.

Once you have all your billable hours in the software, generating invoices is incredibly easy. With a few clicks, PracticePanther can compile all your billables and expenses into a detailed invoice. You can immediately send it to the client via an email or text with a payment link, the client portal, or the mail.

Is There Any Free Invoicing Software?

While yes, there are options for free legal billing software for small firms, legal professionals must tread carefully when considering free software due to various factors unique to the legal industry. Here are several reasons why opting for free time and billing software may not be the wisest choice for law firms:

- Privacy and Security: Law firms handle sensitive information daily. Most free invoicing software doesn’t offer the high level of security needed to protect this data from unauthorized access.

- Features That Meet Legal Needs: The billing requirements of law firms are unique. Free software often lacks the custom features necessary for accurate time tracking, expense management, and client trust accounting.

- Reliability and Support: When you encounter problems with free software, finding fast and effective support can be difficult. For busy legal professionals, any downtime can lead to lost revenue and client dissatisfaction.

- Regulatory Compliance: Law firms must comply with numerous regulations, including those related to billing and financial transactions. For example, there are several ethical rules surrounding the acceptance of credit cards as payment. Free software solutions may not be designed to meet these strict standards, putting your firm at risk of non-compliance.

Given these challenges, investing in reliable, paid billing software becomes a strategic and ethical decision for small law firms.

How Do I Set up Billing for My Small Law Firm?

Setting up billing in a small law firm may seem daunting, but with the right software, it can be straightforward and efficient. A platform like PracticePanther simplifies this process significantly, making it a smart choice for lawyers looking to streamline their billing operations.

The PracticePanther setup process is designed with busy lawyers in mind. Here’s how you can start using PracticePanther for your billing processes:

- Sign Up: Begin by creating an account. This account gives you access to all the features needed to manage your firm’s finances.

- Personalize Your Billing Settings: Begin by configuring your billing preferences in PracticePanther. You can set up standard billing rates for various services or customize rates for specific clients or cases.

- Customize Your Invoices: Use PracticePanther’s legal invoice templates to reflect your firm’s branding. Adding your logo and adjusting the layout is easy.

- Input Client Information: You can easily add or import client details into the system, saving time on future billing. If you don’t have time to transfer all your client and case data, PracticePanther’s data migration team can handle this for you.

- Track Time and Expenses: Log billable hours directly through PracticePanther and attach expenses to client matters without hassle.

- Generate Invoices: With a few clicks, transform logged hours and expenses into professional invoices ready to send to clients.

- Manage Payments: Activate PantherPayments as your payment processing system. This native feature enables you to accept credit card and eCheck payments securely, no additional fees required.

Setting up billing for your small law firm doesn’t have to be complicated or costly. With PracticePanther, you can manage the entire billing process, from rate setting to payments, in one convenient platform for as low as $49 a month per user.

Why not see how PracticePanther can transform your billing process? Try a free trial or book a demo today and experience firsthand how much easier managing your law firm’s finances can be.