Billing clients is foundational to success at any law firm, yet too many lawyers struggle with getting paid on time, if at all. If you’ve ever chased down a payment, you’re not alone. To put some numbers to this sweeping issue, research conducted by Xero & PayPal uncovered that over 48% of invoices sent by small businesses are paid late. Another study by Quickbooks reports that businesses are, on average, owed around $300,000 in late client payments. That’s a staggering amount of money left on the table.

For something as critical as getting paid, it should be as simple as sending an invoice and receiving a payment. But in reality, law firm billing isn’t just about those two steps; it’s about everything in between. And small inefficiencies in your billing process can snowball into major cash flow issues. With law firms already operating on relatively tight margins, finding ways to accelerate isn’t just helpful—it may be keeping your lights on and doors open.

So how can your firm make sure clients pay in a timely manner? It all starts long before you even send an invoice. Here are the five proven strategies to ensure your clients pay on time:

1. Set Clear Expectations with a Transparent Billing Policy

One of the biggest reasons clients delay payment? Confusion. While that might sound too on the nose, a recent study found 29% of past-due clients simply forgot to submit their payments.

If a client doesn’t fully understand what they owe, when it’s due, or whether late fees apply, they’re more likely to push payment aside. That’s why your billing policy should be clear, upfront, and easy to understand from day one.

How to communicate your billing policy effectively:

- Be upfront during the initial consultation – Explain your rates (hourly, flat fee, contingency, etc.), when invoices will be sent, and when payment is expected

- Include every detail in your engagement letter – Clearly list out your billing terms in writing & have clients acknowledge their understanding of them before starting work

- Use plain language – While legal proceedings require an expansive vocabulary, your clients don’t need the legal jargon. Make it easy for them to grasp their financial obligations

- Set expectations for late fees – If you charge late fees, you MUST be upfront about them, similar to how this bullet is included in the first tip. Be explicit about how they work to avoid client disputes later on down the road

What this looks like in action: As an attorney who bills hourly, you might say during the initial consultation: “My rate is $300 per hour, and we send invoices on the first of the month. Payment is due within 15 days to avoid a 5% late fee.” This sets a clear expectation before any work begins.

As Sissela Bok, a renowned philosopher and ethicist, discusses in her essay “Can Lawyers Be Trusted?” transparency is crucial in maintaining trust. Public distrust of the legal profession often stems from a perception that lawyers violate basic moral principles. By making your billing policies crystal clear, you reinforce trust, reduce disputes, and encourage clients to pay on time.

Key Takeaway

A well-communicated billing policy eliminates confusion, builds trust, and ensures clients know exactly what to expect, which makes them more likely to pay on time.

2. Offer Multiple Payment Options to Clients

When it comes to paying for legal services, law firms can’t take a one-size-fits-all approach. It’s no secret that legal services can be expensive, and if clients don’t have flexible payment options, they may look elsewhere.

Start with a Mutually Beneficial Payment Structure

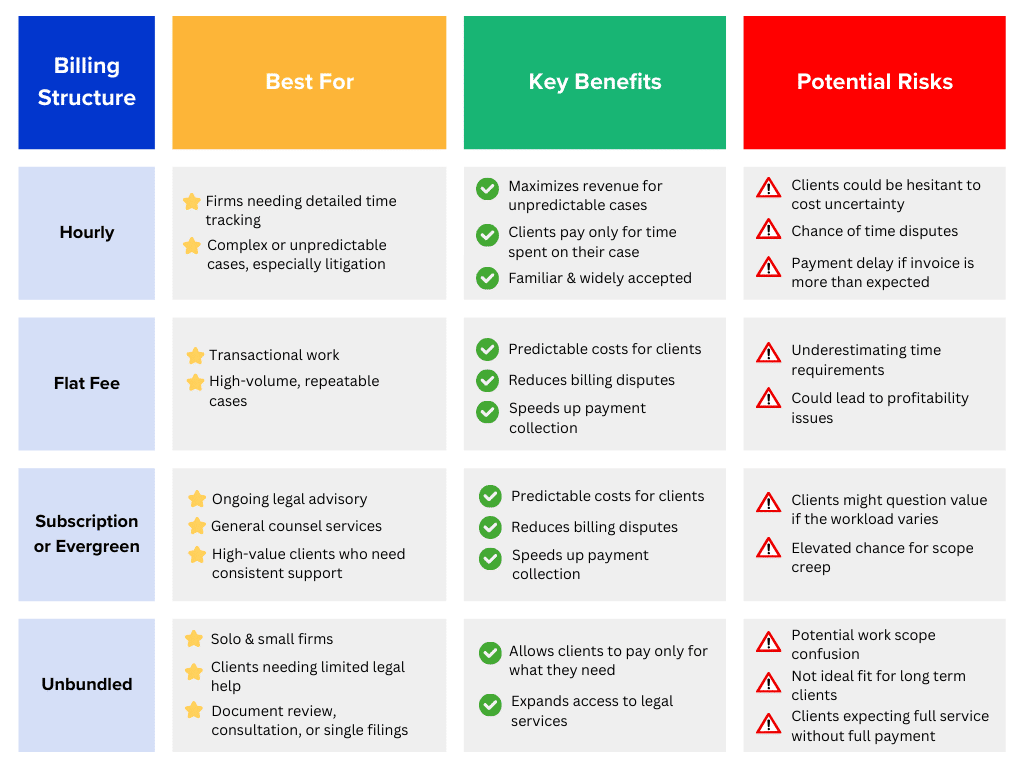

The payment options you provide will depend on the type of law you practice. Many firms today now offer multiple different payment options to better align with client needs and ensure they pay can on time. Providing alternatives beyond the traditional billable hour can strengthen your client’s trust and confidence while making payments more predictable and manageable. A few common options include:

Flat Fee Billing

While reports of the death of the billable hour are a bit overblown, the recent surge in preference for a more predictable fee structure can’t be ignored.

Many firms are starting to charge a flat fee which allows clients to know their costs upfront. This is ideal for cases or projects with predictable work scopes. Requesting payment upfront to a trust account can prevent missed payments. If your firm handles a high volume of similar cases, flat fees can be a convenient option.

For example: A family law firm handling uncontested divorces could charge a $3,000 flat fee to avoid hourly tracking and late payments.

Clients appreciate the simplicity of a single payment, and you avoid chasing checks regularly. However, be cautious: if a case takes longer than expected, you might miss out on additional fees. It’s crucial to assess each situation carefully before deciding on a flat fee.

Subscription or Evergreen Trust Replenishment Model

More and more firms are moving to a subscription model for ongoing projects or clients that want to engage them on a regular basis. Under this model, you establish a monthly rate and charge the client on an ongoing basis before the work is performed via an evergreen trust deposit replenishment.

For example: On the 1st of each month, you charge the client a flat, consistent rate via a deposit to your trust account. When those trust funds are earned fees at the end of the month, you can compliantly move them over from your trust account to your operating account.

This model gives clients open access to their attorney without the restrictions that hourly billing may present. However, most clients will still want at least a basic invoice for services rendered at the end of each month for their records. Similar to flat-fee billing, use your best judgment in establishing a monthly rate with your client: some months, you may work more than you anticipated, while others, you need to perform less work for that particular client.

Unbundled Services

Unbundled services, or limited scope, enable your firm to offer clients a choice of services rather than a full package. This approach helps clients pick from a list of smaller tasks, like legal research or document drafting, and pay à la carte instead of having to opt-in to unnecessary services included in a full-scope fee. This makes legal services more accessible while ensuring payment for completed work.

When deciding to offer unbundled services to clients, you can charge them an upfront, flat fee to your trust account, a payment after services are rendered to your operating account, or a more standard hourly rate.

Payment Plans

Many attorneys prefer to bill clients on a more traditional hourly basis. However, one of the main reasons hourly clients don’t pay their bills on time is that they can’t afford to pay the full cost of their bills in one payment.

In response, many firms have started allowing their clients to pay over time to help ease the burden of the cost of legal services. With payment plans, the firm decides the payment intervals (weekly, monthly, etc.) and the amount of each payment, and the client pays down their balance over time.

Increase Cash Flow by Offering Compliant Online Payment Options

Today, clients expect digital payment options like credit cards or eChecks. Offering online payment speeds up cash flow and reduces manual processing time. However, firms should use caution in selecting an online law firm payment provider to ensure that the processor they choose complies with local, state, and ABA rules for payment processing.

3. Track Time as You Work & Send Clear Invoices Promptly

Now that your clients have read through your billing process, selected the payment option that works best for them, and entered into an agreement for your services — it’s now your responsibility to be as transparent with them as possible about the time you spend on their behalf with accurate time-tracking and easy-to-read invoices:

Effective Time Tracking

Not only will accurate time tracking provide peace of mind to your clients, but it will actually yield you more money. According to the American Bar Association, attorneys who wait to capture their time at the end of each week can lose as much as 50% of their billable hours.

Being diligent about your timekeeping can be challenging, but the easiest way to stay on top of it is to record your time as it happens using a practice management platform.

- Use built-in timers that you can start/stop in one click so you don’t miss billable work

- Log time from anywhere using mobile cloud-based tracking

- Use pre-set time entries for everyday tasks to reduce constant manual entry

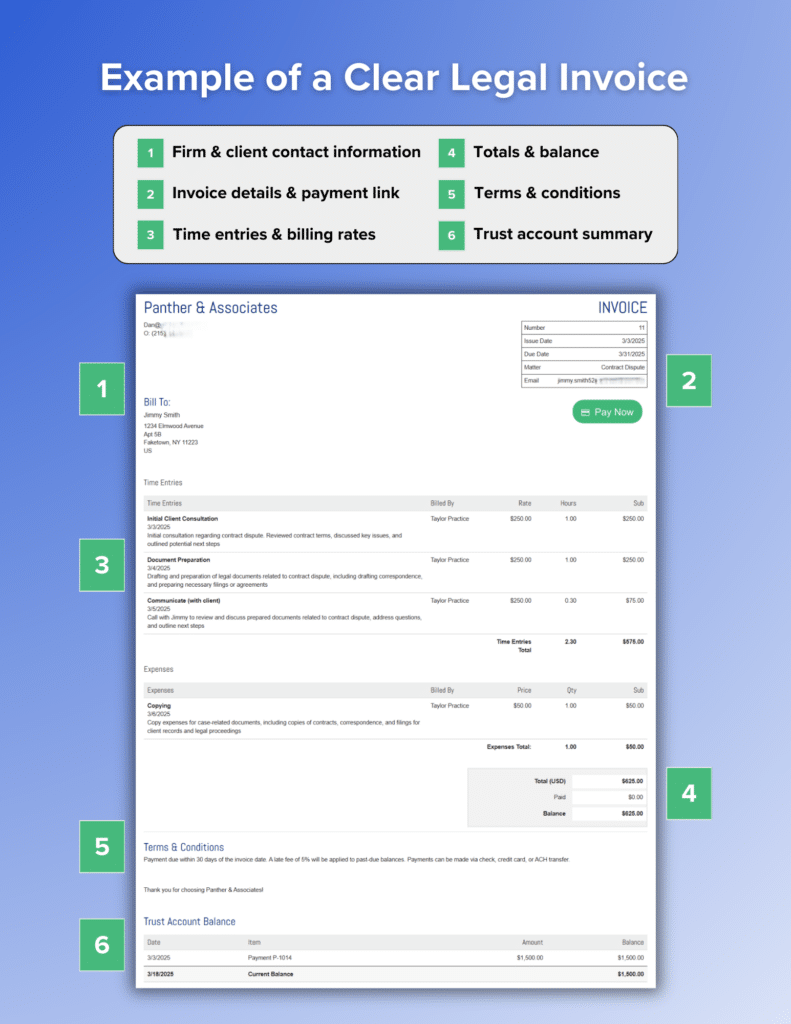

Send Timely, Easy-to-Understand Invoices

A key function of an effective accounts receivable process is to make sure your invoices are easy to follow, 100% accurate, and sent in a timely manner. Providing a clear picture of how much time was spent where, with detailed notes about relevant tasks, will help settle any disputes your client may have about the overall price.

Remember, they’ve already agreed to your set rate based on your detailed pricing, so the better time tracking you have in place, the harder it will be for them to decline payment or request a discount.

Key Takeaway

Tracking time as you work and sending clear, timely invoices helps to significantly reduce client disputes, prevents lost revenue, and gets your firm paid faster.

4. Keep Clients up to Date with Automated Reminders

Sending your clients regular status updates about upcoming payment deadlines, missed or late payments, or any late fees accruing for overdue invoices is crucial to getting paid on time and collecting the full amount. In fact, a recent study found that businesses that consistently follow up on 90% or more of their invoices are most likely to get paid within a week of the invoice date.

With practice management software, these tasks can even be automated with workflows and delivered to digital client portals, meaning you’re providing real value without having to manually send messages.

Automate Payment Reminders

Your clients probably don’t ignore your invoices on purpose. However, they often lose track of the due date due to the barrage of other emails and messages they receive daily. Automated reminders solve this by reminding clients of your invoices and making it easy for them to pay immediately.

- Set up a cadence of reminders for approaching due dates, past-due notices, and late fees so you never have to remember to follow up manually

- Send reminders via email and text to ensure they reach clients where they prefer to check messages

- Include a secure payment link in each reminder, allowing clients to click and pay right then and there

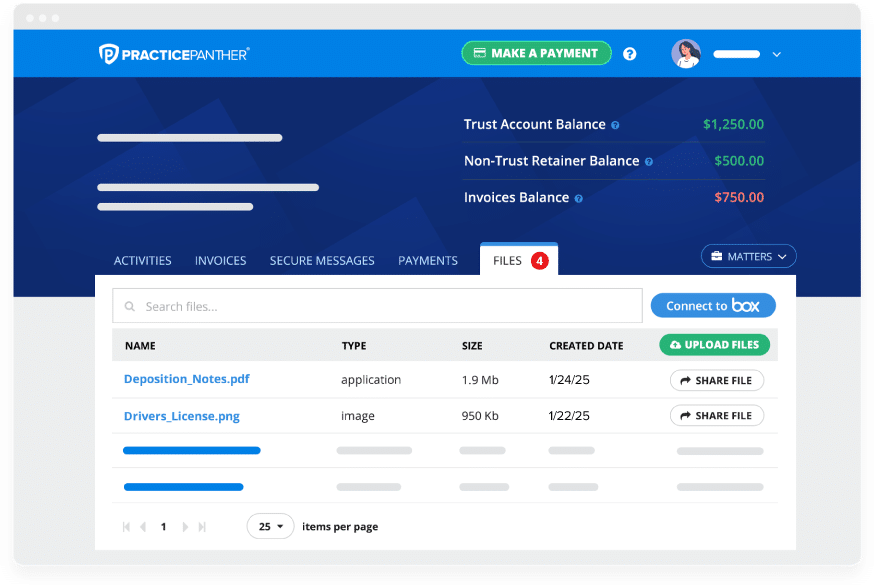

Communicate Through Secure Client Portals

A digital client portal centralizes attorney-client communication in one secure place, ensuring messages, tasks, documents, and invoices are easily accessible from anywhere. Instead of waiting for clients to dig through old emails or needing to call your office, they can log in, see what you need or what they owe, and complete the action immediately.

Regular and transparent communication with your clients keeps your firm top of mind and ensures that a payment request isn’t deleted or lost in a junk mailbox.

Key Takeaway

Automated reminders and secure client portals ensure your payment requests are not lost or ignored. Your firm can stop sending manual follow-ups by scheduling timely email and text reminders with embedded payment links and providing a central place for clients to view and act on invoices.

5. Make Payments Convenient (And Make Your Clients Happier)

At this point, you’ve done everything right — you’ve set clear billing terms from day one, your clients understand when to expect your bill, and your communication with them has been consistent and ongoing. You provided a tremendous service to your client, you captured time contemporaneously, and your invoice has been prepared with meticulous detail. But there’s still one critical step — actually getting paid.

The easier you make this process, the more likely you will get paid quickly and collect 100% of your billed time. Clients expect a simple, frictionless payment experience, just like when they pay for anything else online. That’s where direct payment links come into play.

Remove Payment Barriers with a Direct Link

A universal direct payment processing link allows clients to pay their bills with a single click, reducing delays caused by complicated payment processes. The best way to ensure clients have easy access to pay is to place this link in high-visibility areas, such as:

- Your website’s payment page, so clients can submit payments anytime without requesting an invoice

- Your email signature, so every email from you or your staff includes a direct way to pay

- Within invoices and payment reminders, clients can pay the exact moment they receive the invoice

A direct payment link is flexible enough to work with any billing structure. Let’s go through some examples of how it can be used with a few of the different structures we discussed earlier:

- Hourly Billing: Embed the link when sending an invoice with detailed time entries. Clients can click and pay instantly.

- Flat Fee: Include the link in your Letter of Engagement or retainer request to collect to allow your client to make a compliant one-time payment to your trust account. If integrated with a law firm management platform, payments can automatically update client records, saving time on data entry.

- Subscription or Trust Replenishment: Send the link at set intervals to automate trust account replenishments or recurring payments. Clients receive a reminder with an easy way to pay.

The easier you make it for clients to pay, the faster and more consistently you’ll collect payment on time. A well-distributed payment link makes paying your firm feel as seamless as checking out with an online retailer—no account creation, no extra paperwork, just click, pay, and you’re done.