Come tax season, it’s not unusual for legal professionals to face steep tax bills partnered with strict deadlines. Though it’s tempting to dive straight into lawyer tax deductions, lawyers must understand the importance of expense documentation. In the event of a tax audit, the Internal Revenue Service (IRS) will likely request proof of the business expenses tied to the deductions.

While documenting and accurately providing your business expenses can be a time-consuming and tedious process, it’s essential to gather all your lawyer tax deductions as soon as possible to ensure you gain the most savings come April 18.

Due to the potential for an audit, you will need to be sure of two things. First, you need proof of the deduction you are taking, such as a receipt, credit card statement, or paid invoice. Second, you need to be sure the deduction is legally allowed. Your accountant should catch deductions that are not allowed and let you know that you cannot use them, but if they are miscategorized or marked as something else, it’s possible that they will slip through.

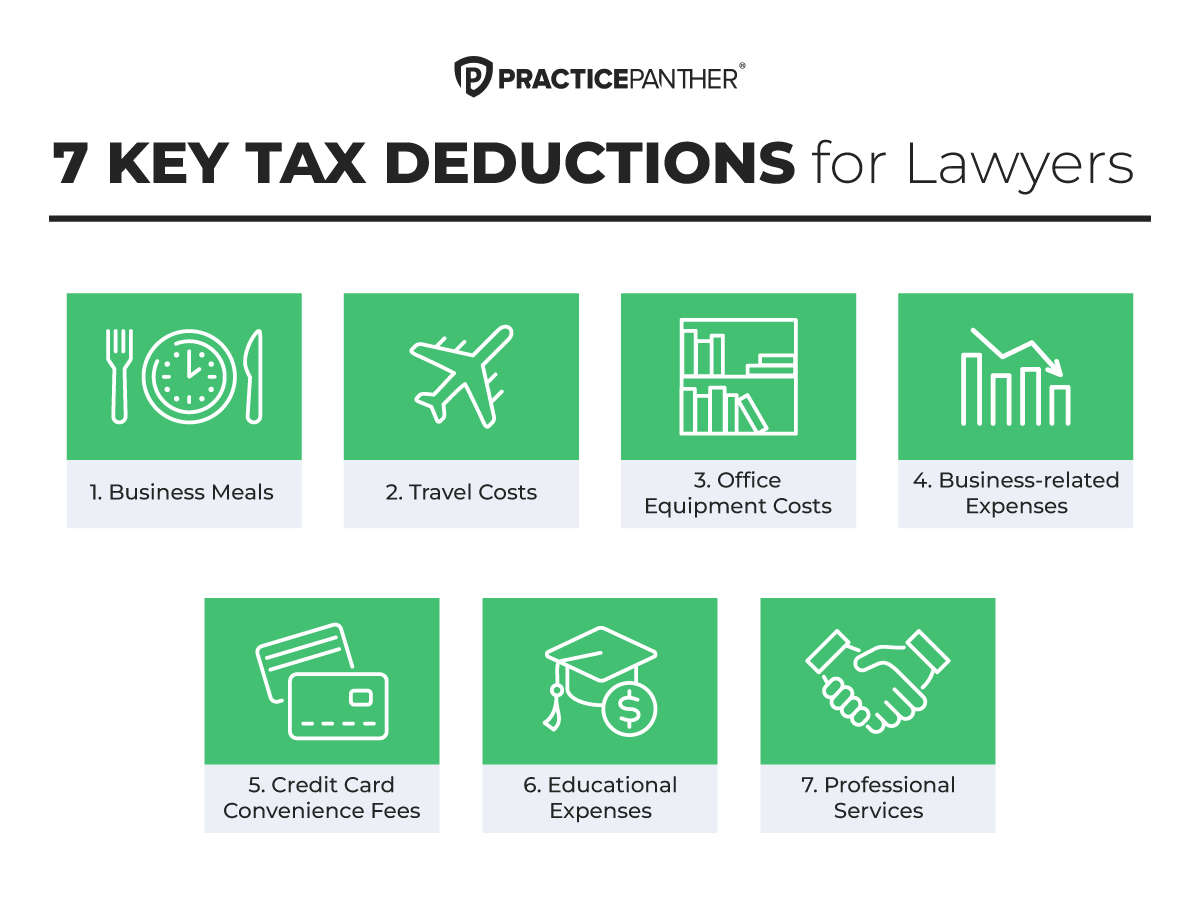

Taking the time to document everything as you go along correctly reduces the chances of a problem if you are audited and also reduces the stress you might otherwise experience in getting everything together as tax time gets closer. Now that you know you must be armed with the proper documentation for optimal savings let’s discuss the top seven tax deductions for lawyers.

Business meals are a critical component of outreach and networking efforts for many law firms and solo attorneys to help obtain prospective talent and clients. Given that networking is viewed as a business expense, meals are tax-deductible so long as the professional claiming the expense is present at the time of the meal and is discussing business with the accompanying individual.

These two aspects of the deduction both matter. Having dinner with a past client and catching up on life events, for example, would not qualify as a deduction because you were not discussing business with a current client. The same would be true if you had lunch with a family friend and provided them with unofficial legal advice. While deducting these kinds of meals may be tempting, they are not allowed under IRS guidelines.

Under general tax law, 50% of the total business meal cost can be claimed as a lawyer tax deduction. However, the IRS has recently issued a temporary enhancement to allow taxpayers to deduct the total expenses of business meals between January 1, 2020, and December 31, 2022. Come the new year, all business meal tax deductions will return to the original 50% limit.

With business meal tax deductions often abused by taxpayers, lawyers must ensure they keep all records of their business meals in the event of an IRS inquiry. Record-keeping efforts can include documenting and saving all cost receipts for each business meal and filing away all electronic meeting invites you sent from your practice management solution.

Travel is necessary for many legal careers, as lawyers often must attend court hearings or visit conferences in neighboring cities or states. Because travel can be required for work purposes, the IRS views these costs as tax-deductible business expenses. However, as with business meals, travel expenses must be strictly related to the primary business to be filed as a tax deduction.

When considering which lawyers can deduct travel expenses, there are many associated costs to keep in mind. Tax-deductible travel expenses include air transportation and required ground transportation costs, like taxis, buses, trains, and even Uber. Hotel lodging and any necessary meal expenses are also considered business travel expenses as long as they relate to the primary business.

With many costs associated with travel tax deductions, attorneys (and the law firm as a whole) must document all travel expenses throughout the year. Once collected, select a secure file to store evidence of these costs. From airplane ticket confirmations to lodging receipts, the IRS may request that you provide proof of each expense in the event of an audit.

If you are asked for proof of a travel expense, you do not want to have to disclose that you also took your family or that you incorporated a vacation into your work trip. These kinds of travel expenses are not allowed by the IRS, and you could find that you are facing fines and audits for those types of deductions. You can protect yourself and your law firm by clearly separating anything that should be a legal travel deduction from anything that involves personal time, such as a vacation day in the city where a hearing took place.

A significant tax deduction for attorneys that many often overlook is the cost of various office equipment. According to the IRS, up to $1 million worth of machinery or equipment purchased for a property used for business purposes can be tax deductible. For lawyers, these equipment costs often include office furniture like desks, chairs, and filing cabinets, as well as office equipment such as computers, printers, office supplies, and even practice management software.

With more lawyers working from home recently, many have wondered whether their home office expenses are also tax deductible. Those who run their law practice from home, in a designated office space, can deduct a portion of home office expenses. Home office deductions for lawyers often include rent or mortgage, utilities, and insurance. Bear in mind the IRS uses specific calculations when determining home office deductions, so anticipate deductions will vary from home to home.

When operating a law firm, countless business-related expenses accompany growing and managing a successful practice. A typical example of a law firm business-related expense is general marketing campaign expenses. Any money spent on developing marketing materials — such as print ads, online advertisements, and website development — and any professional marketing services or software is tax deductible.

A prominent tax-deductible business-related expense all lawyers should be aware of is annual employee wage costs. Since employees provide a service to your law firm, their salaries are considered a business-related expense. To ensure fair deductions, the IRS requires employee compensation to be reasonable in amount and necessary for the operation of your law firm.

Another business related-expense many lawyers need to realize is tax deductible is their retirement contributions. According to the IRS, law professionals who contribute income to a qualifying retirement account, such as a SIMPLE IRA or a Solo 401(k) plan, are reducing their overall taxable income and automatically qualifying themselves for business-related tax deductions.

Due to the numerous stages of various legal processes, many law firms must wait several months for complete payment — while other firms must wait weeks after sending an invoice to receive the cash for services provided. In hopes of faster payments, some law firms accept credit cards to help combat delayed revenue; however, they’re also burdened by credit card convenience fees.

With an average convenience fee of 2.5%, law firms that process numerous credit card transactions per year can find themselves with thousands of dollars worth of year-end expenses. Fortunately, the IRS allows law firms to deduct all credit card convenience fees as a business expense, so long as the fees are paid in full by the law firm (meaning your clients can’t cover them). Be sure to gather documentation of all convenience fees from each processor at the end of each year for more accessible filing.

The IRS allows lawyers to deduct the necessary expenses for the cost of employee education or training and the costs of personal education required to operate a law business. To qualify for personal education expense tax deductions, you must demonstrate the education costs required by law to maintain your status as a licensed attorney. For instance, Continuing Learning Education (CLE) courses are required by law for law licensing purposes.

Because deductible education expenses must strictly relate to the ability to perform as a legal professional, extracurricular courses, such as marketing and website development, are not considered tax deductible. However, one thing to remember is that legal professionals with previous underlying student loan debt can claim up to a $2,500 deduction from loan interest when filing personal income taxes. Again, have all this documentation on hand when filing taxes.

As with any variety of business, law firm operators often consult with outside professional services to help guide and complete the various internal tasks required for an overall successful operation. A typical example of outsourced legal services is an accounting and tax preparation service that collects and manages a firm’s finances but is entirely separate from the law firm itself.

Law firms commonly use additional professional services, including business consultants, marketing professionals, and even outside lawyer services, all of which are considered tax-deductible professional service expenses. Maintain well-documented proof of each service and paid invoice confirmations to help accelerate the tax filing process and avoid IRS audit concerns.

Your accountant can help you clarify which professional services are deductible and which are not. Keeping all receipts can help you sort through this issue with your tax professional, so you receive the maximum deduction to which you are entitled without trying to deduct anything that may not be allowed under IRS rules.

When it comes to tax deductions for attorneys, the best way to maximize savings come tax season is to maintain optimal documentation of all expenses, from meals and travel costs to office equipment and other business-related expenses. Invest in a practice management solution equipped with expense reporting to track expenses autonomously all year.

Expense reporting software can help track all case expenses, like parking and other travel necessities, that can be billed to a client. A simplified dashboard enables lawyers to easily attach a picture of a receipt, even from a cell phone, to ensure no expense goes untracked. With every expense squared away, it will be easier to maximize deductions by April.

Thank you for reading our Law Firm Finances Guide! If you’ve found the information in this guide helpful, feel free to share it. If you’re interested in taking the next step towards complete control over your law firm finances, enhance your financial management plans with PracticePanther. To learn more about how our legal practice management software can help support all your financial management needs, schedule a demo today.