Traditional billing processes with manual time entry, disconnected invoices, paper checks slow down operations and create uncertainty. Missed billables, delayed payments, inconsistent formats…it all adds up to lost revenue and unnecessary friction with clients.

Legal billing software offers a more effective approach. Automating the billing process allows firms to work more efficiently, bill more accurately, and collect payments faster. But it’s not just about speed. It’s about visibility, consistency, and building a more predictable financial foundation for your practice.

Firms that embrace legal e-billing software are rethinking how billing fits into the broader business of law. From time capture to collections, they’re building systems that help teams stay accountable, reduce errors, and give clients a better experience at every step.

In this guide, we’ll unpack what legal e-billing actually means, how it works, and what to look for in a platform built for modern legal professionals.

What Is an Effective Legal E-Billing Process?

An effective legal e-billing process should be accurate and automated wherever possible. It should make life easier for your team and crystal clear for your clients. Ideally, you’re using a legal e-billing platform that connects to the rest of your practice management software, providing a single source of truth for your firm. In general, your legal e-billing process should look something like this:

Track Time Accurately

Every billing cycle starts with time capture. Attorneys and staff should log billable hours as they occur—during calls, client meetings, or court appearances—to avoid gaps or inaccuracies later. Consistent time tracking ensures transparency, supports accurate invoices, and strengthens client trust.

Generate Professional Invoices

Once time entries are complete, they’re compiled into invoices. Legal e-billing systems typically allow you to customize invoice formats, ensure LEDES compliance when required, and apply rates, taxes, or discounts automatically. The goal is to create clear, professional invoices that reflect the value of your services.

Send and Track Invoices Electronically

E-billing eliminates manual follow-up by allowing firms to send invoices directly through secure digital channels. Attorneys can monitor when clients receive, open, or pay their invoices. This effectively reduces the need for back-and-forth communication and minimizes administrative overhead.

Automate Payment Reminders and Collections

Following up on overdue payments is one of the most time-consuming parts of billing. Automated reminders and status tracking help firms stay on top of receivables without repetitive manual outreach. Adding late-fee policies can also encourage timely payments.

Simplify Payment Collection

E-billing works best when paired with easy, digital payment options. Allowing clients to pay online by credit card, ACH transfer, or other secure methods shortens the payment cycle and improves cash flow. The simpler it is to pay, the faster firms get paid.

Review Reports and Financial Insights

At the end of each billing cycle, it’s essential to review performance metrics. Reporting tools within e-billing systems can reveal outstanding balances, client payment patterns, and matter profitability, helping firms make informed financial decisions and improve long-term billing strategies.

An effective e-billing process marries automated tasks with human oversight. It should be easy for both your team and your clients, and with the right resources in place, it can be.

Key Features and Functions of Legal E-Billing

Your legal electronic billing system should be doing the heavy lifting for you. From the moment time is tracked to the payment landing in your account, each step should be smooth, accurate, and easy to manage. Here’s what to look for, and how PracticePanther delivers real value across the billing process.

Customizable Invoices

Not every client or case is billed the same way. You need invoices that match your billing structure and still look professional. PracticePanther lets you customize invoice templates with your logo, billing method (hourly, flat fee, contingency), and detailed descriptions, so your bills are clear and polished.

Time Tracking That Feeds Billing

Time tracking is the foundation of billing. With PracticePanther, timers are built directly into your workflow. You can track time while drafting, emailing, or even in court and it all links back to the right matter.

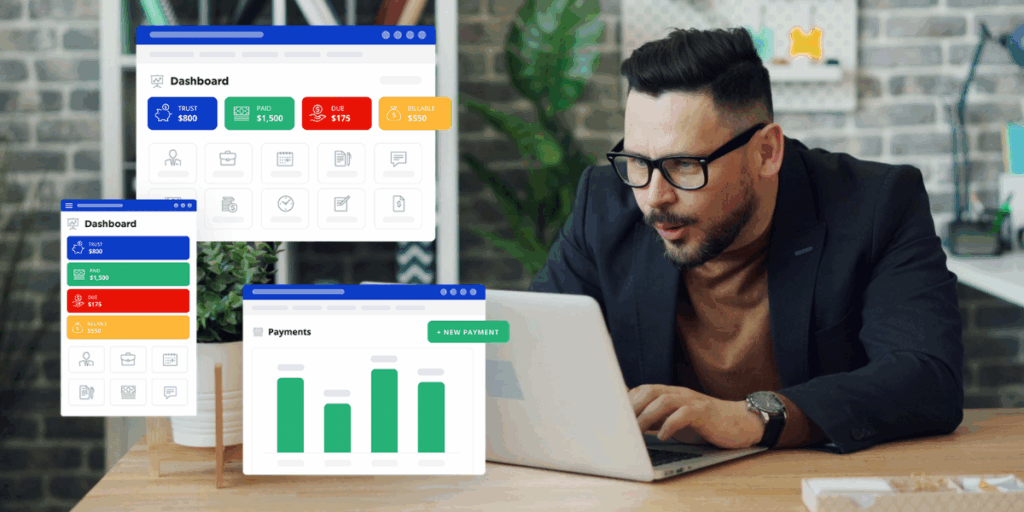

Detailed Reporting

Need to see what’s outstanding, which matters are the most profitable, or which clients are chronically late? PracticePanther’s billing dashboard and custom reporting give you a bird’s-eye view of your firm’s financial performance.

Accurate Billing, Every Time

When billing relies on memory or manual entry, mistakes happen. PracticePanther pulls time entries, rates, and expenses directly into your invoices, reducing human error and keeping every invoice compliant with your clients’ billing guidelines.

Payment Reminders That Run Themselves

Following up on overdue invoices is awkward and time-consuming. With PantherPayments, you can automate polite, timely reminders that nudge clients to pay without adding another task to your list. PracticePanther integrates directly with PantherPayments, so your clients can pay by credit card or ACH with just a few clicks. No paper checks. No faxed PDFs. Just faster payments and fewer headaches. (Bonus: firms using PantherPayments get paid up to 70% faster than the industry average.)

Invoices Clients Can Actually Use

If a client needs to download, print, and mail back a check, you’ve lost momentum. PracticePanther makes invoices easy to access through a secure client portal and even easier to pay with a credit card or ACH via PantherPayments.

A Seamless Billing Workflow

The best billing systems don’t exist in a vacuum. PracticePanther’s workflows connect billing with your time tracking, matter management, and client communications so the entire process runs without roadblocks or duplicate work.

Benefits of Legal E-Billing Software

In the legal industry, billing has long been viewed as a back-office function. Important, yes, but primarily administrative. That mindset is shifting. Forward-thinking firms are treating billing as a strategic lever. With the right technology in place, e-billing can be a catalyst for stronger financial performance and sharper business decisions.

Firms that adopt e-billing platforms are improving accuracy at every step, from real-time capture to automated payment reminders. They’re turning raw billing data into insights that influence hiring decisions, pricing models, and client strategy. They’re using built-in controls, like legal invoice review software, to enforce consistency across attorneys and stay in compliance with increasingly complex client billing guidelines.

When your billing system is fully integrated into your matter management, time tracking, and payment software, you’re creating a financial record of how your firm works. You know which clients are profitable, which cases stall in collections, and which billing models yield better results.

All of these details matter now more than ever, as clients are scrutinizing costs and law firm overhead is rising. The pressure to do more with less isn’t going away. The firms that will thrive are the ones that treat billing as a strategic function, supported by smart, scalable systems.

That’s what PracticePanther enables: a single platform where your e-billing process is efficient and built for the future of law.

If you’re interested in exploring these benefits and more, try PracticePanther for free or schedule your personalized demo.