No matter how skilled your team is or how successful your outcomes are, billing can make or break your law firm’s financial health.

By building billing habits around clear documentation, precise time entry, timely invoicing, and flexible payment options, your firm builds trust and stays cash-flow positive. Legal billing software can help, but only if your processes are consistent.

This guide breaks down what modern legal billing looks like, how to adopt best practices from the start, and where to find tips—including the best legal billing software of 2025 and sample legal billing guidelines. Whether you’re overhauling your current billing setup or just getting started, you’ll walk away with practical ways to protect your time, your team, and your bottom line.

The Four-Step Legal Billing Framework

Most firms follow a four-step billing process:

- Fee Agreement: The firm and client agree on the billing method in a written contract.

- Time Tracking: Legal professionals log their time spent on tasks related to the client’s case.

- Invoicing: The firm generates a bill detailing the services performed, hours spent, and associated costs.

- Payment: The client pays the bill, often using preferred methods like checks, credit cards, or electronic payments.

Each of these steps might sound straightforward, but billing quickly becomes a pain point without strong systems in place. Inconsistent timekeeping, late invoices, unclear guidelines, and messy collections lead to revenue loss, client frustration, and even compliance issues.

Breakdown of the Main Law Firm Billing Methods

There’s no one-size-fits-all approach when it comes to billing at a law firm. Different practice areas, case types, and client expectations all play a role in determining how you charge for your services. Let’s look at the most common billing methods firms use and why each one matters.

- Hourly Billing

This is the traditional model most clients expect, and it remains the most widely used. Lawyers track their time in tenths of an hour and bill accordingly. It’s straightforward, especially for litigation and other work where the scope can shift over time. However, it can also lead to client pushback if hours aren’t logged clearly or if they don’t feel they’re getting consistent value for each billable hour. Following American Bar Association billing guidelines can help maintain transparency and avoid disputes.

- Flat Fee Billing

Flat fees, often categorized as an alternative fee arrangement (AFA), offer predictability for both the client and the firm. They work best for transactional or standardized legal services like drafting contracts, filing trademarks, or handling uncontested divorces. Flat fees encourage efficiency and can help build client trust, but the risk is underestimating the time required. Firms using this model often rely heavily on past experience or data to scope work accurately. - Contingency Fee Billing

This method ties the firm’s compensation to the outcome of the case, typically used in personal injury or other plaintiff-side litigation. If the client wins, the firm takes a pre-agreed percentage of the award or settlement. If not, the firm gets nothing. While this can lead to large payouts, it also involves higher financial risk and requires careful vetting of potential cases. - Retainer Billing

Retainers involve upfront payments that reserve a lawyer’s availability and can be drawn down over time as work is completed. Some firms treat retainers as a type of deposit and bill against it hourly, while others structure them as flat monthly access fees. Retainers offer more stability in cash flow and a consistent client relationship but need to be clearly defined in the fee agreement to avoid confusion or ethical concerns.

Looking for more? Check out our comprehensive guide to legal billing!

What Is an Alternative Fee Arrangement with a Law Firm?

When lawyers talk about an alternative fee arrangement (AFA), they’re talking about creative, client-focused billing methods that go beyond the traditional billable hour. These AFAs can give firms more flexibility and clients more transparency and predictability in legal costs. AFAs can take many forms, depending on the type of legal work and the client’s needs. Some of the popular models law firms use to move away from the billable hour include:

- Flat-Fee Billing: A predictable, pre-set fee for specific services, ideal for straightforward matters like estate planning or contract drafting.

- Capped Fees: You still bill hourly, but there’s a maximum charge the client agrees to upfront. Great for budgeting, but risky if a matter takes longer than expected.

- Blended Rates: One average hourly rate, regardless of who in the firm does the work. This simplifies billing and can offer savings to clients.

- Unbundled Legal Services: Clients choose the legal tasks they want help with and handle the rest themselves. It’s cost-effective and puts the client in control.

- Subscription Billing: Clients pay a monthly fee for ongoing legal support, like document review or consultations. This arrangement is best for long-term relationships and consistent workload planning.

The key to AFAs is finding the one that fits your practice area, your revenue goals, and your clients’ expectations. For a deeper dive into AFAs, check out our Guide to Alternative Fee Arrangements for Law Firms.

Do Lawyers Still Get Paid for Non-Billable Hours?

Yes, but not in the way you might think. Most lawyers, especially those working in firms, receive a salary. That salary covers both billable and non-billable work. However, billable hours are what law firms use to generate revenue. They track how much client-facing work an attorney does and use those hours to determine bonuses, promotions, and long-term career prospects. Non-billable hours, on the other hand, don’t directly bring in money, but they are essential. Think about all the day-to-day tasks that occur, like:

- Attending internal team meetings

- Participating in CLE sessions

- Mentoring junior associates

- Performing pro bono work

- Handling administrative tasks

- Business development and networking efforts

The challenge is that these types of non-billable tasks take time away from billable work, eating into the total hours a lawyer can log toward their targets. After all, in the world of lawyer billing, time is currency. Many firms expect attorneys to hit between 1,700 and 2,300 billable hours each year yet also expect lawyers to contribute to the health of the firm beyond client work. If a firm doesn’t balance billable vs. non-billable expectations well, it can lead to burnout, missed billable targets, and tension between lawyers and leadership. That’s why tracking and understanding non-billable time matters just as much as the client hours you’re invoicing.

What’s the Biggest Reason Legal Invoices Get Delayed or Rejected?

The top reason legal invoices get delayed or rejected outright is simple: failure to follow client billing guidelines. Whether it’s missing matter IDs, vague time descriptions, incorrect formatting, or noncompliance with required LEDES codes, even minor errors can cause major payment delays.

Other common culprits include:

- Duplicate or inaccurate time entries

- Mathematical mistakes

- Missing supporting documents (like purchase orders or change orders)

- Typos in dates, rates, or client details

- Conflicts with agreed billing caps or fee structures

Clients, especially large corporations or government entities, often have strict billing rules, and violating them can trigger invoice rejections through e-billing systems. That leads to time-consuming back-and-forth, missed revenue, and frustrated legal teams.

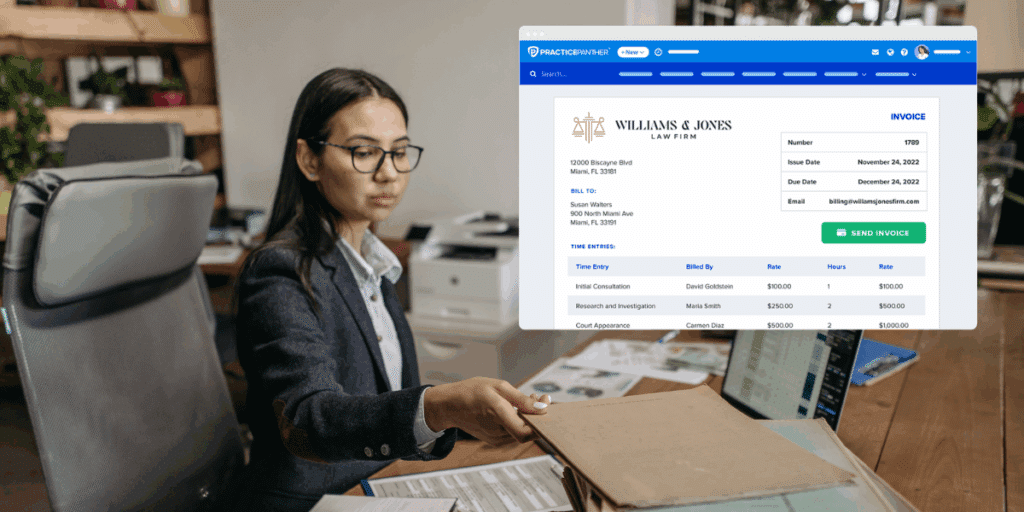

This is where PracticePanther makes a huge difference. With automated time tracking, built-in legal billing software features, and LEDES-compliant invoice generation, PracticePanther helps you reduce errors before they become a problem. You can customize billing templates, attach key documents, and automatically apply client-specific billing rules all in one place. And when it comes time to get paid, PantherPayments accelerates the process.

In fact, firms using PantherPayments get paid 70% faster with compliant online payments that streamline collections and cut down on manual work. That means fewer headaches for your team and faster revenue for your firm.

Steps to Improve Billing Productivity at a Law Firm

Billing shouldn’t be a scramble. With the right systems, communication, and resources in place, your firm can transform billing from a recurring stressor into a streamlined, reliable part of daily operations. Here’s how to tighten up your attorney billing workflow while staying client-focused and efficient, all powered by the features already built into PracticePanther.

- Improve Time Tracking & Billing Accuracy. Accurate time tracking is the foundation of billing. If your data is off, your invoices will be too. You should strive for:

- Real-Time Time Tracking

Manual time logs and memory-based estimates create gaps. PracticePanther’s built-in timers and mobile app make it easy to track time from anywhere. That means fewer missed entries, more accurate invoices, and better insight into how your team spends their day. - Detailed Descriptions

Clients want clarity. Vague line items lead to questions, delays, or even rejections. With PracticePanther, you can add detailed descriptions to every time entry with just a few clicks, making sure each bill reflects the full value of your work.

- Streamline Processes with Technology. Your firm shouldn’t waste time doing work that software can handle. Look for software that can:

- Automate Billing & Invoicing

Repetitive tasks slow everything down. PracticePanther lets you automate invoice creation, set recurring billing schedules, and auto-send reminders, freeing up hours each month. - Standardize Templates

Customizable invoice templates let you build consistency across all matters and clients. This reduces the risk of formatting errors or missed line items, especially when handling high volumes. - Digitize Payments

Accepting online payments through PantherPayments shortens the payment cycle and makes it easier for clients to pay on time.

- Enhance Client Communication & Expectations. Clients pay faster when they understand what to expect. You should:

- Communicate Policies Upfront

Clear fee agreements and billing policies help prevent disputes later. PracticePanther stores client agreements, tracks matter details, and keeps everything accessible for future reference. - Provide Payment Terms

Set expectations early. PracticePanther lets you define payment terms, due dates, and billing cycles and then automatically enforce them with reminders and overdue notices.

- Optimize the Billing Workflow. Consistent billing habits lead to better cash flow and fewer collections headaches. Be sure to:

- Bill Consistently

Consistency builds trust. Weekly or biweekly billing through PracticePanther helps avoid month-end backlogs and shows clients you’re responsive and professional. - Follow Up on Overdue Invoices

Automated follow-up messages and late fee triggers mean your team doesn’t have to chase payments manually. PantherPayments handles the reminders so your invoices don’t get forgotten. - Review Performance

Use PracticePanther’s built-in reporting to monitor billing metrics across attorneys, matters, and clients. Spot trends, track realization rates, and pinpoint where productivity drops off.

- Invest in Your Team. Billing is everyone’s responsibility, not just the finance department’s. It’s important to:

- Provide Training

Even the best billing system won’t help if no one knows how to use it. PracticePanther is easy to learn, and built-in onboarding and support make adoption simple for attorneys and support staff alike. - Foster a Culture of Efficiency

When everyone on the team knows how billing impacts the firm’s financial health, they become more proactive. PracticePanther gives your team visibility into time entries, invoice status, and collections, so they can stay accountable without micromanagement.

Following these steps will improve your billing productivity and reduce friction across your entire firm. From fewer rejected invoices to faster payments and more satisfied clients, the right billing practices create a healthier, more sustainable business. PracticePanther makes it easy to put these habits into action, designed for speed, accuracy, and automation.

If you’re ready to make billing the easiest part of your day, try PracticePanther for free or scroll to the bottom of this blog and click the button to schedule your personalized demo. Either way, you’ll see how PracticePanther makes attorney billing faster, easier, and way less stressful.