When you’re running a small firm, every software you use has to pull its weight. You don’t have time for clunky billing processes, confusing software, or chasing down payments week after week. You need comprehensive legal billing and invoicing software to help you save time and stay organized.

In this blog, we’ll dig into what makes law practice legal billing software transformational for small firms, what features to look for, and how to find a solution that fits your workflow and your budget.

What Software Do Law Firms Use for Billing?

Law firms really have two paths when it comes to legal billing software: use a standalone solution that handles only invoicing and payments, or choose an all‑in‑one system that connects billing into every part of your practice, such as PracticePanther. For small law firms and solo practitioners, the difference can affect the entire law firm’s operations.

Let’s take a quick look at each:

Standalone Billing Platforms

These platforms focus purely on invoicing and payments. They might allow you to send invoices, accept payments, and track outstanding balances, but that’s about it. That means your time tracking, matter management, trust accounting, and client communication live elsewhere. You end up juggling multiple systems, exporting data, and manually coordinating work across systems.

All‑in‑One Practice Management Solutions

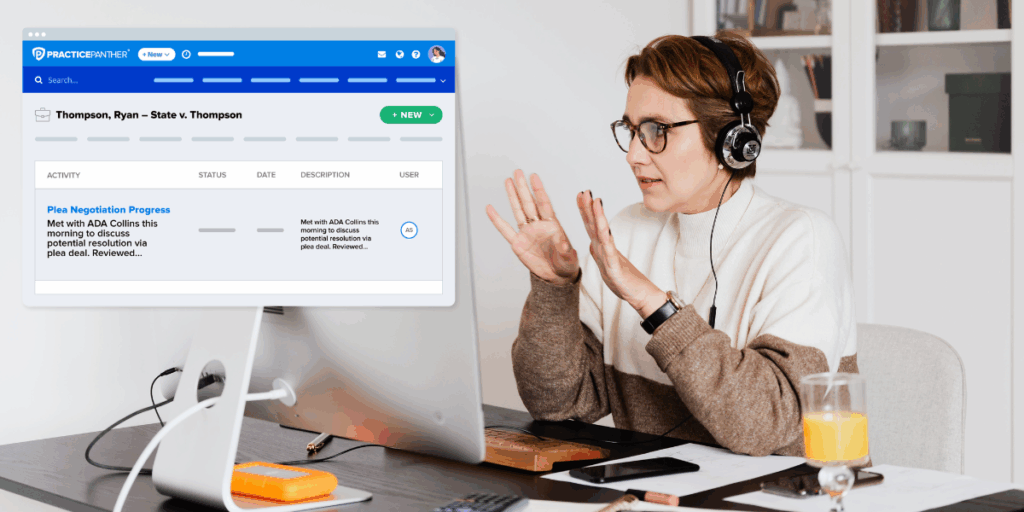

In contrast, an all-in-one platform like PracticePanther ties billing directly to your matters, clients, timers, and documents so every bill sits in context. With one system handling everything, you reduce duplicate work, avoid lost time entries, and simplify your cash‑flow process. For example:

- Time entries captured in real time roll straight into invoices.

- Custom invoices pull client and matter data automatically.

- Online payments sync with your accounting and trust ledgers.

- Billing, payments, and case work live on the same dashboard.

This holistic approach gives you visibility, speed, and fewer errors.

It’s worth noting that these types of systems do come at a cost. Less expensive standalone billing systems can seem attractive, but these will often cost you more money in the long run due to their clunky, manual processes and the gaps in functionality. Making the right choice now can save you time and money later. Connected systems will help you focus on what you came to law to do: help clients, not chase invoices.

If you’re trying to decide which route makes sense for your firm, check out our more in-depth helpful guide: “Law Firm Software: What to Choose?”

What Are the Most Essential Features to Look For in Legal Billing and Invoicing Software?

The best legal billing software for small law firms and solo lawyers is the one that works for you, not against you. The right platform should tie your billing, payments, case work, and reporting together into a seamless series of workflows. Here’s what to prioritize and how a solution like PracticePanther delivers across the board.

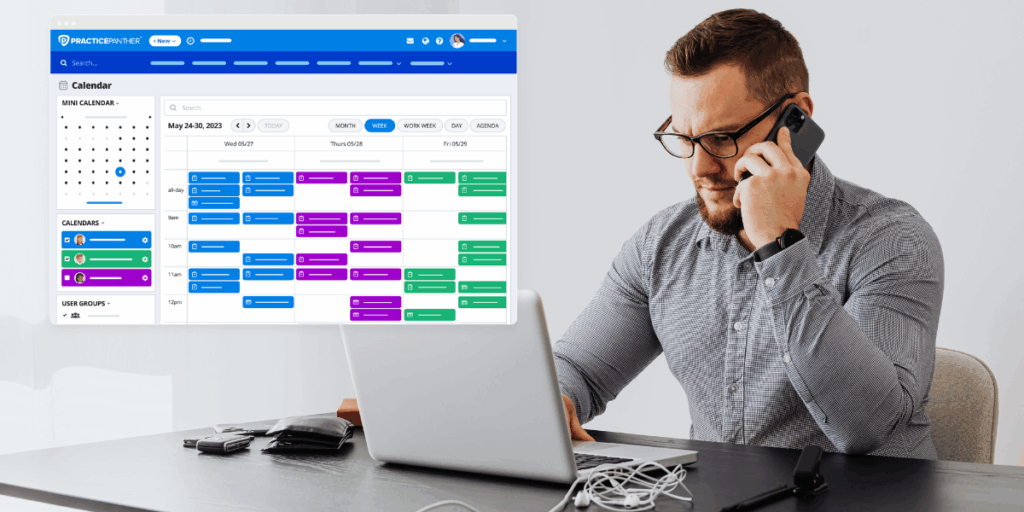

Built‑in Time Tracking for Hourly Billing

Tracking time correctly is the first step to accurate billing. With PracticePanther, you can start timers directly from a matter, phone call, or email, so time doesn’t slip away unlogged. This translates to fewer lost hours and less guesswork at billing time.

Customizable Invoicing and Payment Integrations

Your invoices should reflect your brand and your billing model(s). PracticePanther lets you design invoice templates, pull in time entries and expenses automatically, and embed secure payment links. Clients can pay instantly via credit card, ACH, or e‑check, all without leaving your system.

Automated Reminders and Legal E‑Billing Software Capabilities

The longer an invoice sits unpaid, the less likely you’ll collect in full. PracticePanther’s automated reminders, generate statements, and support e‑billing workflows so billing hiccups don’t turn into cash‑flow problems.

Comprehensive Reporting and Analytics

Good billing software also gives you insight. PracticePanther offers real‑time reporting dashboards so you can see which matters are most profitable, which invoices are overdue, and where time is being spent. That visibility helps you make smarter decisions.

Trust Accounting, Compliance, and Single Platform Convenience

For law firms of all sizes, compliance is non‑negotiable. PracticePanther includes trust account management, deposits, disbursements, and audit‑ready records so you can stay aligned with bar rules and avoid messy workarounds. The big win? All of this lives in one platform with no separate systems, no multiple subscriptions, and no data silos.

Easy Adoption and Robust Support

A great system isn’t helpful if your team never uses it. PracticePanther focuses on ease of use, mobile access, and provides support and resources so you can transition smoothly and get value quickly.

How to Choose Invoicing Software Based on Firm Size and Practice Area

Selecting the right invoicing system isn’t a one‑size‑fits‑all decision. Your firm’s size, practice area, budget, and growth goals all matter. Here’s a practical guide to help you pick wisely:

1. Budget: Start with What You Can Afford

For solo attorneys or small teams, it’s tempting to reach for the lowest‑cost or “free” option. But since billing touches every client, matter, and payment, you’ll want something more reliable. Budget for a solution that delivers automation, integration, and support, not just basic invoicing. A good rule: pick a platform that pays for itself in reduced admin time and faster collections.

2. Identify Your Firm’s Pain Points

Start by asking: “What about our current process frustrates us most?” Is it time tracking, billing delays, too many invoices outstanding, or perhaps difficulty accommodating flat‑fee models? Once you’ve nailed the biggest bottleneck, you can look for software that tackles those issues head‑on. For example, firms whose main problem is manual billing may benefit most from features like PracticePanther’s automation workflows.

3. Scalability: Will It Grow With You?

Today you might be a solo or small team, but your future could look different. Look for solutions that scale and can easily support more users, more cases, and possibly new practice areas without forcing you into separate systems. Integration is key: does the platform sync with your accounting system, trust accounting rules, matter management, document storage, and other apps? You can gauge your readiness with a quick check‑in like our Law Firm Growth Quiz, which highlights how modern systems support scalable growth.

4. Customer Support and Onboarding Matter

Be sure to review how easy onboarding is, how responsive support is when you run into challenges, and whether the vendor offers tutorials or best‑practice guidance.

By matching your budget, addressing real pain points, future‑proofing for growth, and checking support quality, you’ll be far more likely to land a solution that delivers. Choosing software that fits your size and practice area sets you up for today and for sustainable growth moving forward.

A great example of this comes from Slingbaum Law, a small, hybrid firm that was using fragmented systems and manual workflows for key processes. After switching to PracticePanther, they reported completing cases roughly 25 % faster and saving over 15 hours each week thanks to workflow automation and connected billing.

If you’re ready to see similar results, try PracticePanther for free today. Or click the button below to schedule a personalized demo and explore how our platform can work for your firm.