Running a law firm today means managing a lot of moving parts. That’s why many firms are turning to law practice legal billing software as more than a convenience. In fact, the latest ABA TechReport highlights how law firms of all sizes are increasingly embracing billing software as central to effective practice management. But not all billing solutions are created equal.

For solo attorneys, small practices, and mid‑size firms alike, the ideal solution is an all‑in‑one system that combines billing, matter management, document handling, payments, and communication into one seamless workflow.

Factors to Consider When Shopping for Legal Billing Software

Choosing software that fits your firm is vital for growth. It’s important not to rush into a decision, and it pays to compare software against key criteria. Below are the most significant factors to consider before investing in the best legal billing software for your firm.

Key Factors to Evaluate

- Scalability and Firm Growth: Make sure the system can grow with you. Whether you’re a solo attorney or you build a mid‑sized practice, the platform should support more matters, more users, and a broader scope of work.

- Easy Adoption and User Experience: Complexity kills adoption. The best solutions are intuitive for everyone, from attorneys and paralegals to support staff.

- Customer Support and Onboarding: A great product alone won’t help if you can’t implement it smoothly. Look for vendors with solid support, clean onboarding, and resources to help bring your team up to speed.

- Integrations and Flexibility: Chances are your firm already uses other systems, like email, calendars, cloud storage, or accounting solutions. The right law practice system can either integrate with those apps or replace them outright. That kind of flexibility avoids friction and preserves workflows.

- Single Subscription, Access Everything You Need: Instead of paying separately for each functionality, an all-in-one model bundles everything. That’s easier to manage, cheaper in the long run, and less confusing than juggling multiple subscriptions and tracking licenses, seats, and permissions across a plethora of platforms.

Why an All‑In‑One Solution Always Wins

Many firms start with separate systems: one for time‑tracking, another for document management, maybe a third for payments, and a spreadsheet for invoices. That patchwork can quickly lead to inefficiencies, data silos, and missed opportunities. Legal technology experts note that a single system that brings together all these functions reduces redundancy and makes workflows more seamless.

With a fully integrated platform, everything connects: time entries, matter files, payments, and accounting. That reduces errors, improves compliance, and helps teams work together rather than across disconnected systems.

Using a unified system eliminates redundancy and automates busy work, turning case management and billing from a chore into a smooth, efficient workflow.

What Features Make the Best Law Practice Legal Billing Software?

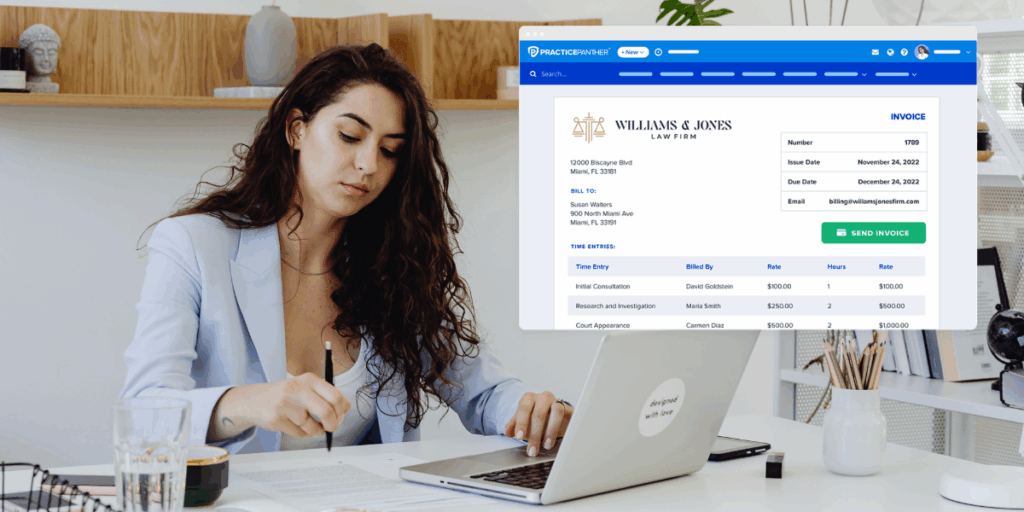

Whether you’re a solo attorney, a small firm, or running a larger practice, what you really want is a system that works with you, not against you. That’s why many firms end up choosing an all‑in‑one system like PracticePanther. Below are the features that consistently matter (and how PracticePanther delivers them) for all firms, then broken down by size.

What Every Firm Needs

These are must‑haves, no matter your firm’s size.

Billing and Invoicing Flexibility

What it Does: Supports different billing arrangements and simplifies invoice creation.

Why it Matters: Firms need billing that matches how they charge clients without added administrative work.

Key Capabilities Provided by PracticePanther

- Customizable invoice templates

- Clear billing descriptions that clients can understand

- Support for hourly, flat fee, contingency, retainer, and recurring billing

- Batch billing and scheduled invoice creation

- Automated payment reminders

Firm Benefits

- Faster invoice turnaround

- Reduced administrative effort

- Improved cash flow

Payments, Trust, and Compliance

What it Does: Speeds up payments while supporting ethical and regulatory requirements.

Why it Matters: Delayed payments and trust accounting errors create risk for firms.

Key Capabilities Provided by PracticePanther

- Online payments by credit card, eCheck, and ACH

- Click-to-pay links and client portals

- Trust and IOLTA accounting safeguards

- Three-way reconciliation support

- Clear trust activity shown on invoices

Firm Benefits

- Shorter payment cycles

- Lower risk of compliance issues

- Greater transparency for clients

Reporting and Firm Growth Insights

What it Does: Turns billing data into actionable business insights.

Why it Matters: Firms need visibility to make informed staffing and pricing decisions.

Key Capabilities Provided by PracticePanther

- Realization and collection rate reporting

- Write-off tracking

- Organize and track profitability by attorney and matter

- Billable hour monitoring and recovery

Firm Benefits

- Better financial visibility

- Smarter practice-area decisions

- Support for long-term growth

Usability, Security, and Client Experience

What it Does: Encourages adoption while protecting sensitive firm and client data.

Why it Matters: Billing systems only deliver value when attorneys and clients actively use them.

Key Capabilities Provided by PracticePanther

- Intuitive interface with role-based dashboards

- Minimal steps to enter time

- Strong mobile access

- Encryption, access controls, and audit logs

- Secure client portal for invoices, payments, and communication

Firm Benefits

- Faster adoption and higher utilization

- Reduced billing friction

- Stronger client trust and satisfaction

Time and Expense Tracking (for Firms that Bill Hourly)

What it Does: Captures billable work and costs as they happen, so firms don’t lose revenue.

Why it Matters: Unrecorded time and missed expenses directly reduce firm profitability.

Key Capabilities Provided by PracticePanther

- Multiple timers and matter-based time entries

- Mobile time entry with offline capture

- Expense tracking with categories, receipts, and matter assignment

- Automatically add time and expenses to invoices

Firm Benefits

- Fewer missed billable hours

- Cleaner billing records

- Easier support for audits and rate discussions

Firms rarely operate in a vacuum. Maybe you use an accounting program, cloud storage, calendar apps, or external document repositories. Effective, simple legal billing software systems are flexible and integrate with other apps, rather than duplicating effort. When you’re evaluating software, be sure to keep this in mind and look for these types of features.

Billing Features for Small Firms and Solo Practitioners

If you’re running a smaller firm or flying solo, you’ll want a system that gives you maximum value without unnecessary complexity.

Built‑in Time Tracking & Automated Invoice Generation: Automatic timers and matter‑linked entries mean no more reconstructing hours from memory.

Native Billing & Payments: Generate invoices directly from tracked time or expenses, and allow clients to pay with online payment options (which reduces delays and keeps your cash flow predictable).

Simple, Unified Interface: When you’re wearing many hats, ease of use matters. Look for one login, one dashboard, and everything centralized so you don’t have to bounce between apps.

Scalable Foundation: Even if you’re small today, the platform should grow with you. You don’t want to outgrow your billing software after just a few new clients.

Billing Features for Mid‑Size to Large Firms

As firms expand, so do their needs. More clients, more matters, possibly different practice areas. Here’s what you should look for.

Flexible Billing Models (Hourly, Flat‑Fee, Retainers, Recurring Billing, etc.): Different cases demand different billing structures. Software should support all of them fluidly.

Advanced Reporting and Analytics: The ability to generate financial reports by matter, attorney, client, or practice area is essential for understanding which parts of your firm are profitable, where write‑downs occur, and where workflows lag.

Document and Compliance Features: Secure document storage, audit‑ready records, trust accounting support, and integrations to meet regulatory requirements.

Inter‑department/Multi‑user Access Control: For larger teams, you need user permissions, role‑based access, and centralized control so billing, case management, and document workflows stay organized and secure.

With these components, software becomes a true foundation for firm management as a whole. It helps handle complexity while keeping your overhead manageable.

Overall, whether you are looking for legal billing software for a solo practitioner, a growing small firm, or a large law office, the right features make all the difference. Before committing, think about where you are now and where you want to be in a year or three.

If you want a deeper dive into what features a complete platform should offer, read our features guide.

How Does All‑in‑One Legal Billing Software Reduce Operational Costs?

Firms that switch from fragmented programs to an all‑in‑one legal practice system often report:

- Fewer hours spent on billing admin and reconciling accounts

- Less overhead cost tied to software, servers, or manual compliance tasks

- Faster invoicing, quicker payments, and steadier cash flow

- Clearer financial reporting and better profitability tracking

In a business where every hour and every dollar matters, and where compliance, trust, and transparency are non‑negotiable, a connected billing platform is a strategic investment that helps sustain your long‑term success. With a native platform like PracticePanther, you’ll see:

Efficiency Gains Translate to Lower Operational Costs: An all‑in‑one platform replaces dozens of disconnected systems and manual processes, so you’ll spend less time juggling spreadsheets, switching between apps, or re‑entering data. You’ll bill fewer hours to admin tasks and have more hours available for actual client work. Plus, because everything is centralized and cloud‑based, overhead costs drop: no need for separate servers or multiple software licenses.

Increased Accuracy Reduces Risk and Waste: Administrative errors often lead to lost revenue, compliance headaches, or client disputes. With integrated systems, you get automatic linking of time entries, matter details, expenses, invoices, and payments, minimizing underbilling or overbilling. You’ll also have benefits like:

- A unified trust‑accounting and accounting system, reducing compliance risks and the overhead of reconciling records across platforms.

- Less risk of lost files, mis‑filed invoices, or misplaced communications—especially valuable for firms dealing with multiple clients, cases, or trust accounts.

That kind of reliability protects your firm from accidental write‑offs, audit penalties, and client dissatisfaction.

Transparent Financial Visibility for Smarter Decisions: With a connected platform, financial data doesn’t live in a spreadsheet on someone’s hard drive: it’s visible in real time to whoever needs it. That makes it easier to track which matters are profitable, which are lagging, and where write‑downs happen.

You can forecast cash flow and plan expenses or staffing accordingly, and spot trends (e.g. long payment delays, recurring write‑downs) and address them proactively rather than reacting after the fact. This visibility transforms billing from a chore you hope gets done into a strategic asset that guides your firm’s growth and resource allocation.

How PracticePanther Helps This Criminal Defense Law Firm Efficiently Manage 5,000+ Cases a Year

Eckart Wostmann Wiese is a criminal‑defense firm that handles over 5,000 cases a year. Before using PracticePanther, staff lacked the clarity and visibility needed to quickly review client collections, which was an immense drain on time and capacity.

With PracticePanther, the firm streamlined workflows: matter setup, conflict checks, case tracking, billing, and payments all live in one system. That eliminated redundant work, sped up turnarounds, and let the firm manage massive volume with the same core team. The operational efficiency gains translate directly into saved time that can now go toward client work instead of paperwork.

On the financial side, the payoffs have been clear. With native billing and online payments, the firm reports faster collections—PantherPayments takes clients only 10 seconds and three clicks to complete payments. In a high‑volume environment, those faster payments trickle up into steadier cash flow and more predictable revenue cycles.

By consolidating systems into PracticePanther’s unified platform, Eckart Wostmann Wiese turned what used to be admin-heavy operations into an efficient, scalable, and more profitable model, demonstrating strong ROI for adopting an all‑in‑one legal practice management solution.

How Secure Is All‑In‑One Legal Billing Software?

In general, all-in-one law practice software is secure, but some options offer more security features than others. For example, PracticePanther provides 256-bit military-grade data encryption to protect client and firm data in a single, unified space.

Additionally, cloud‑based platforms, like PracticePanther, offer protections such as data encryption, off‑site backups, regular security updates, and centralized permissions. All-in-one systems generally offer better security due to:

Centralized Access Control and Encryption: All client information, invoices, trust accounting, and file storage live on the same secure platform with standardized protection.

Audit‑Ready Compliance and Disaster Recovery: Cloud‑based law‑practice platforms provide built‑in backups and redundancy. That means even if hardware fails or there’s a cyber‑attack, your data stays protected and retrievable.

Fewer Hand-offs, Fewer Leak Points: When billing, case management, payments, and documents are all connected, there are fewer opportunities for data to be copied or shared insecurely, which reduces risk of breaches or accidental disclosures.

While these points hold true for most central solutions, it is worthwhile to evaluate each platform’s specific security features.

The case study mentioned earlier is a solid example of this. When Eckart Wostmann Wiese set out to manage those 5,000+ criminal defense cases each year, security was non-negotiable. As a 100% cloud-based firm, they process a high volume of extremely sensitive medical and personal documents.

For Managing Partner Stephany Eckart, PracticePanther’s HIPAA compliance and 256-bit military-grade data encryption stood out from the competition. “The safety and security of our client information, files, and medical documents are a top priority for our firm,” she said. “I chose PracticePanther because it had the highest level of security compared to anyone else out there.”

That peace of mind comes from knowing that everything from billing, documents, trust accounting, payments, and beyond runs through a single secure system with industry-leading encryption, U.S.-based servers, and strict compliance protocols.

When you’re evaluating what tech to use in your firm, you should think about security first. A decision to use a law practice legal billing software shouldn’t be based solely on convenience. It should be about protecting your clients, your data, and your firm’s future.

Try All-in-One Law Practice Legal Billing Software for Free

From cash flow improvement to airtight security, we’ve walked through the many ways all-in-one legal billing software can make your firm more efficient and better prepared for growth. Instead of juggling multiple disconnected experiences, PracticePanther offers a single, secure platform that ties together billing, case management, document handling, trust accounting, calendaring, and more.

Ready to see PracticePanther in action? Start your free trial today, or click the button below to schedule a demo.