Ever feel like your billing system is a little disconnected? You’re not alone. It’s a challenge many law firms face, especially when their tech stack has been cobbled together over the years. The problem is that your disconnected systems cause mistakes, missed revenue, and serious frustration for both your team and your clients.

That’s why top-performing firms are shifting to fully native legal billing software. Not just another system to bolt on, but a connected, all-in-one law practice legal billing software that ties together your time tracking, invoicing, payments, and client communication.

Why Is Native Legal Billing Crucial for Law Firms?

When billing systems are disconnected from the rest of your operations, things fall through the cracks: time entries get lost, invoices go out late, payments lag…and your accounting team is left untangling the mess.

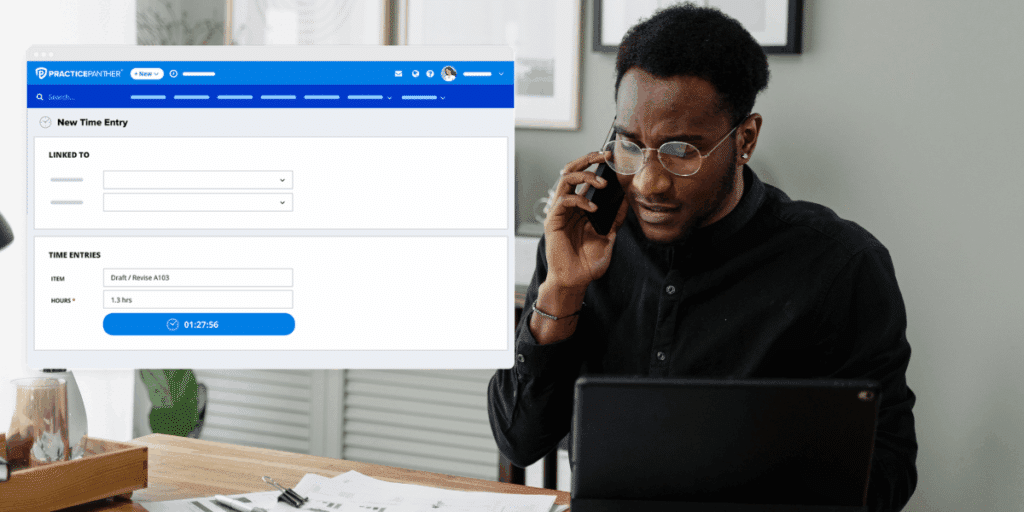

That’s why native legal e-billing software is a business necessity, not a mere “nice-to-have.” Native billing lets you automatically capture time as you work, replacing all those post-it notes and guesswork at the end of the day. Attorneys can generate accurate invoices in just a few clicks using real-time entries, send them electronically, and process multiple invoices at once with batch billing features.

And when clients don’t pay on time? Automated reminders take the pressure off your staff while improving collection rates. Plus, with built-in online payment capabilities, firms can give clients a smoother, faster way to pay via credit card, ACH, or eCheck. Payment links can be embedded directly into invoices, and secure client portals let clients manage bills and even set up recurring payments. Some systems allow clients to pay off multiple invoices in one transaction, with funds automatically applied to the correct matters.

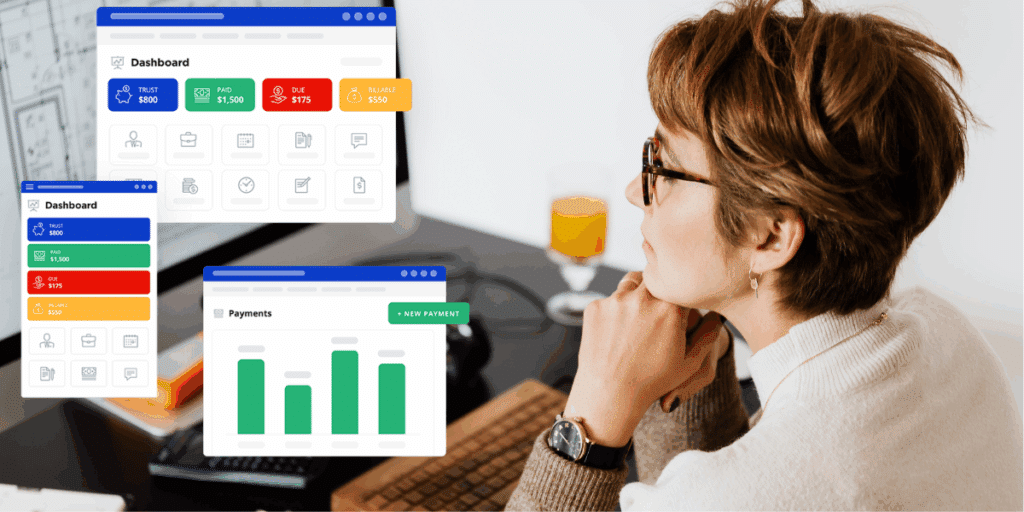

A native platform gives you a full financial picture. Connecting to accounting platforms like QuickBooks eliminates double entry and syncs everything from billing to taxes. Built-in financial reports help you monitor revenue, outstanding balances, and payment trends. And for firms managing trust accounts, many systems are designed with IOLTA compliance in mind. Flexible options like payment plans help your clients handle large balances more comfortably, while your firm maintains a healthy cash flow.

A quick word of caution: while there are plenty of options out there for free legal billing software, most fall short when it comes to integration and long-term functionality. They may help you create an invoice, but they often lack the automation, reporting, and compliance features needed to scale a modern firm.

That’s why all-in-one systems are important. And when your billing platform is built into your legal practice management system, every part of your workflow connects: time tracking, matter management, invoicing, payments, and reporting. Our platform offers the infrastructure to support healthy, sustainable financial management.

How Does Native Billing Improve Cash Flow for Firms?

For most law firms, getting paid on time is a constant balancing act. Invoicing takes time, clients delay payments, and it’s easy to lose track of what’s been billed, paid, or forgotten altogether.

Fully connected billing can make a huge difference. You’ll see benefits like:

- Clients Pay Faster (Without the Follow-Up Dance)

Automated reminders and client-friendly payment portals take the pressure off your team. Instead of chasing down overdue invoices, you can set up friendly nudges that go out automatically and give clients an easy way to pay online. The fewer steps they have to take, the quicker you get paid. - Fewer Mistakes, Fewer Disputes

When your time tracking, invoicing, and case management all live in the same system, you’re less likely to run into billing mistakes. That means fewer disputes and invoices that get paid without extra drama. - Real-Time Financial Visibility

Want to know which clients have paid and which ones still owe? With fully integrated billing, you don’t have to wait until the end of the month. You can check your dashboard and get a clear picture anytime, which makes managing your cash flow a whole lot easier. - A Smoother Experience for Everyone

Clients don’t love complicated invoices any more than you do. When they can log in, view their balance, and pay it in a few clicks, they’re more likely to follow through.

What Are the Operational Benefits of Using Native Legal Billing Software?

For law firms managing clients, cases, deadlines, and invoices simultaneously, a disconnected billing process can feel like swimming upstream. But when you switch to a connected platform where everything is linked, the benefits go well beyond “we get paid faster.” Here are how the operational advantages break down, especially when using a system like PracticePanther:

- Increased Efficiency That Frees Up Your Team

Manual billing eats up hours. With native billing features like time tracking and automated invoicing, that changes. Attorneys and support staff can log time as they work and generate invoices in a few clicks. PracticePanther’s streamlined system even lets you send batch invoices and set payment reminders without lifting a finger. Clients get electronic invoices with click-to-pay links, and you get faster payments without bottlenecks. - Improved Accuracy and Transparency

Billing errors can damage trust and cost your firm additional money. Native platforms reduce those risks with automated calculations, customizable templates, and clear, itemized invoices. Your clients see exactly what they’re paying for, and your firm builds credibility with every bill sent. - Enhanced Compliance and Trust Accounting

Trust accounting errors can land a firm in serious trouble. PracticePanther’s trust accounting features help you track client funds separately, maintain IOLTA compliance, and generate audit-ready reports whenever you need them. It’s built-in protection for your clients and your reputation. - Scalable, Customizable Reporting

All-in-one billing platforms give you real-time reporting on profitability, collections, and time spent per matter or attorney. As your firm grows, you can adapt your billing rates, structures, and templates to fit client needs without overwhelming your admin team.

If you’re looking for proof, be sure to check out the legal billing software reviews.

For example, here is a PracticePanther success story from Megan Will. She’s a solo estate planning and real estate attorney in Pennsylvania, and turned to PracticePanther after struggling with clunky billing systems and delayed payments. Since switching, she’s collected payments 88% faster using PantherPayments and trimmed her monthly billing workload from hours to just minutes. With everything from automated workflows to cloud-based access, she’s now running her practice more efficiently, freeing up more time for clients and less time chasing invoices. Read the full story

What Are the Steps to Measure Cash Flow Improvement After Implementing A Native Billing System?

So our blog convinced you, and you’ve made the switch to an all-in-one billing system. Great! But how do you actually know it’s working? Measuring cash flow improvement is about tracking the right metrics. Here’s how to gauge the impact, and how PracticePanther’s simple legal billing software makes that process clearer:

1. Track Time-to-Payment

Start by comparing your average “days outstanding” on invoices before and after implementing your new billing system. With PracticePanther, clients can pay instantly online via PantherPayments (credit card, ACH, or eCheck), cutting down delays and smoothing your income stream. If your DSO (days sales outstanding) drops from 45 to 30 days, that’s a win worth noting.

2. Monitor Collection Efficiency

How much time do you spend sending invoice reminders, following up by email, or calling clients to nudge them? With PracticePanther, automated reminders and batch billing take care of that. The less time your team spends chasing payments, the more time they can spend on client work.

3. Check Your Financial Dashboard Often

One of the best ways to measure improvement is real-time financial visibility. PracticePanther’s billing solution lets you see what’s paid, what’s pending, and what’s overdue, all in one place. This kind of access makes it easier to plan ahead and catch problems early so you can feel confident about your firm’s financial footing.

4. Pay Attention to Client Behavior

Don’t forget about your clients’ experience too. Are they paying faster? Asking fewer billing questions? Logging into their client portal to pay multiple invoices at once? An improved payment experience keeps your cash flow predictable and your client relationships strong.

With PracticePanther, you’ll have access to all these metrics and more. And, they aren’t hidden in spreadsheets or lost in inboxes. They’re right where you need them, when you need them. Ready to see the difference for yourself? Start a free trial or schedule a demo using the button below.